In the rapidly evolving landscape of decentralized finance (DeFi) and Web3 applications, user onboarding and regulatory compliance remain persistent challenges. Traditional Know Your Customer (KYC) procedures are cumbersome, repetitive, and often at odds with the privacy-centric ethos of blockchain. Self-sovereign identity (SSI) wallets are emerging as a transformative solution, enabling users to complete a one-time KYC verification and reuse their credentials across multiple platforms. This model not only streamlines digital onboarding but also strengthens user privacy and data control.

Redefining Identity Ownership in Web3

The core principle behind self-sovereign identity wallets is simple yet powerful: individuals own, manage, and present their digital credentials without reliance on centralized authorities. Unlike conventional identity systems where personal data is siloed by each service provider, SSI wallets leverage decentralized identifiers (DIDs) and verifiable credentials to grant users granular control over what information they share and with whom.

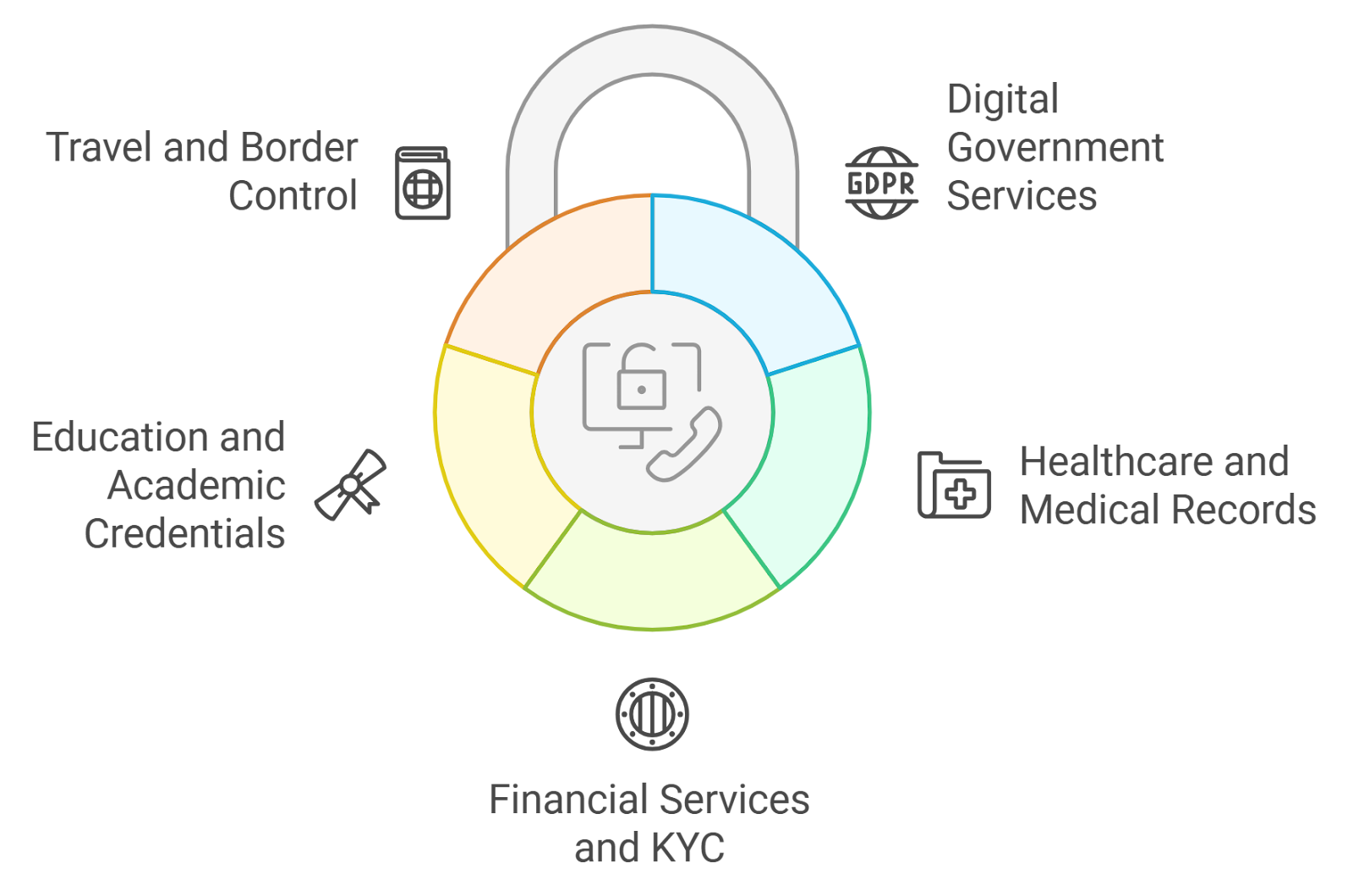

This paradigm shift aligns perfectly with the foundational values of Web3 – decentralization, privacy preservation, and interoperability. By storing credentials such as government-issued IDs or KYC attestations in a secure wallet, users can seamlessly interact with DeFi protocols, NFT platforms, DAOs, and more without repeatedly exposing sensitive information.

One-Time KYC: The Foundation for Reusable Access

The traditional KYC process is notorious for its inefficiency. Each new platform requires users to submit the same personal documents and undergo redundant verification checks. This not only creates friction but also increases the risk of data breaches as personal information is scattered across numerous databases.

SSI wallets solve this by enabling a one-time KYC experience. After verifying their identity through a trusted provider, users receive a verifiable credential stored securely within their wallet. When accessing new dApps or services that require compliance checks, users simply present this credential for instant verification, no need to resubmit documents or wait for manual approval.

This approach has seen real-world adoption:

- Sumsub’s Reusable Digital ID on Solana: Users complete one KYC process to receive an on-chain credential usable across supported Solana dApps.

- SelfKey Identity Wallet: Empowers individuals to store and reuse KYC data across various Web3 services while maintaining full control over disclosure.

- Altme Wallet: In partnership with Docaposte, Altme provides free KYC verification that results in portable credentials compatible with multiple platforms.

The Benefits: Security, Privacy and Regulatory Alignment

The advantages of decentralized identity wallet reuse go far beyond convenience:

- Enhanced Privacy: Users share only what’s necessary, no more oversharing of documents or sensitive data.

- User Experience: One-time onboarding dramatically reduces friction for both newcomers and experienced DeFi participants.

- Cost Efficiency: Platforms can cut down on duplicate compliance costs by accepting trusted verifiable credentials instead of running full KYC checks each time.

- Regulatory Compliance: SSI solutions help projects meet evolving global standards for Anti-Money Laundering (AML) while respecting user autonomy, a critical balance in today’s regulatory climate.

This user-centric approach is especially relevant as regulators intensify scrutiny over crypto transactions worldwide. Solutions like SSI wallets offer a path forward that respects both legal obligations and individual rights, a rare win-win scenario in digital identity management.

Pioneering Use Cases and Industry Momentum

The market momentum behind one-time KYC Web3 solutions is accelerating. Projects like Cheqd are pioneering cross-platform credential reuse; Altme integrates NFT-based verifiable identities; Sumsub leverages blockchain attestations for seamless dApp access. These innovations are shaping a new standard where portable KYC credentials become the norm rather than the exception.

If you’re interested in exploring how these technologies address persistent compliance hurdles while empowering end-users, see our detailed guide on eliminating repetitive KYC in Web3 through self-sovereign identity wallets.

As adoption grows, the interplay between decentralized identity wallet reuse and regulatory frameworks will remain a focal point. Jurisdictions worldwide are updating guidance on digital identity, often referencing privacy-preserving KYC as a preferred approach. This is particularly true for DeFi protocols seeking to onboard users at scale without compromising compliance or user trust. The flexibility of SSI wallets, where users can revoke, update, or restrict access to credentials at any time, adds a critical layer of risk management not possible in legacy systems.

Beyond compliance, cross-chain identity management is emerging as a key differentiator in the Web3 onboarding experience. Networks like idOS are working to ensure that portable KYC credentials can be recognized and trusted across multiple blockchains and platforms, reducing fragmentation and supporting seamless user journeys between ecosystems.

Risks and Considerations for SSI Wallet Adoption

Despite their promise, self-sovereign identity wallets are not without risks. The integrity of the initial verification provider is paramount, if a credential issuer is compromised or negligent, downstream platforms accepting those credentials may inherit risk exposure. Furthermore, while SSI wallets minimize data leakage by design, improper implementation or insecure storage on user devices could still expose sensitive information.

For organizations evaluating Web3 onboarding solutions, it is essential to conduct rigorous due diligence on both wallet providers and credential issuers. Questions to ask include:

- How are verifiable credentials protected at rest and in transit?

- What recourse exists if a credential is revoked or reported as fraudulent?

- Does the solution support granular consent management for data sharing?

Transparency around these factors will be critical for building institutional trust in reusable digital ID frameworks.

The Road Ahead: Towards Frictionless Digital Identity

The convergence of privacy-preserving KYC technology with decentralized finance marks a turning point for digital identity. As more platforms embrace one-time KYC via SSI wallets, users gain unprecedented autonomy over their personal information while institutions achieve compliance with far less operational overhead. The shift towards portable identity will likely accelerate as standards mature and interoperability improves across ecosystems.

The ultimate vision, secure, reusable credentials that unlock trusted access anywhere in Web3, is fast becoming reality. For those seeking further insights into this evolution, our resource on how portable on-chain identity solves KYC fatigue in DeFi offers an in-depth look at current solutions shaping tomorrow’s digital trust landscape.