In the rapidly evolving Web3 landscape, self-sovereign identity wallets are emerging as a cornerstone for privacy-preserving digital identity and seamless compliance. For years, Know Your Customer (KYC) protocols have been a bottleneck for onboarding users into decentralized platforms, often requiring individuals to repeatedly verify their identity across every new service. This redundant process not only frustrates users but also exposes sensitive data to multiple points of risk. In 2025, the paradigm is shifting: SSI wallets now empower users to verify once and reuse credentials everywhere in Web3.

What Are Self-Sovereign Identity Wallets?

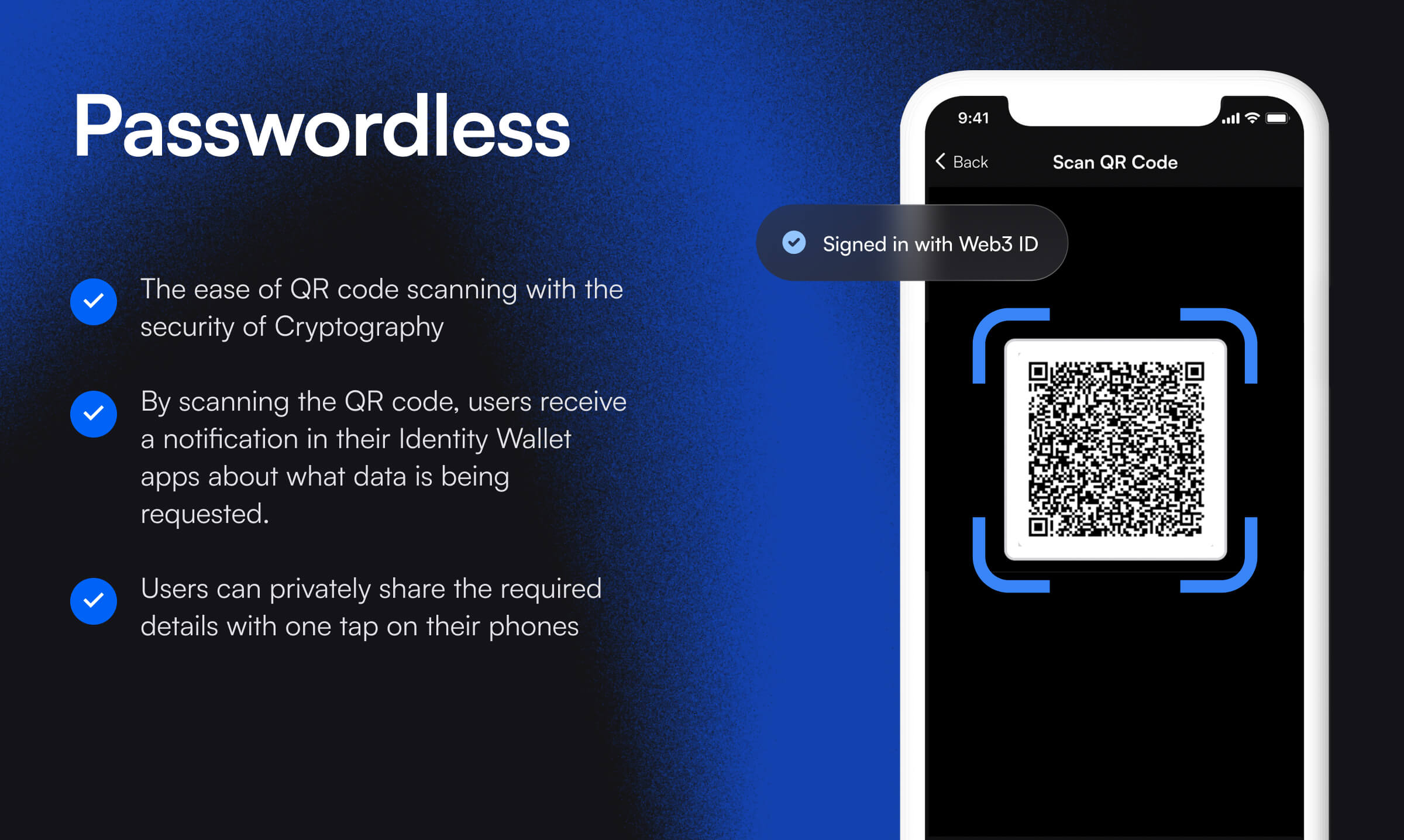

Self-sovereign identity (SSI) wallets are secure digital tools enabling individuals to create, store, and control their own verifiable credentials without relying on centralized authorities. Built on blockchain technology and leveraging decentralized identifiers (DIDs) alongside cryptographic proofs, these wallets allow users to selectively disclose only the minimum required information for any transaction or interaction.

This approach marks a dramatic departure from legacy identity systems where third parties hold and manage user data. Instead, SSI wallets put individuals at the center of their digital lives, granting them true ownership and agency over how their information is shared.

The End of Repetitive KYC in Web3

The traditional KYC process is notorious for inefficiency: every new exchange, DeFi protocol, or metaverse platform demands fresh documentation and manual review. This not only slows onboarding but also increases operational costs and attack surfaces for data breaches. SSI wallets solve this by introducing reusable KYC credentials. Once a user completes an initial verification with a trusted issuer, such as a regulated exchange or an authorized KYC provider, they receive a cryptographically signed credential stored directly in their wallet.

Whenever another platform requests KYC proof, the user can simply present this credential. The platform verifies its authenticity on-chain without ever accessing sensitive underlying documents. This model provides “verify once, reuse often”: is already being adopted by leading solutions like Altme Wallet and Cheqd’s network of credential issuers.

If you want a deeper dive into how reusable KYC works under the hood, see our guide on how self-sovereign identity wallets enable reusable KYC in Web3.

User Control: Privacy Meets Compliance

One of the most compelling benefits of SSI is that it achieves regulatory compliance without sacrificing individual privacy. With traditional systems, personal data is scattered across countless databases, each one vulnerable to leaks or misuse. In contrast, SSI wallets employ zero-knowledge proofs (ZKPs) and selective disclosure techniques so users can prove attributes (like age or residency) without revealing anything else about themselves.

This capability is especially powerful for applications that require nuanced access controls, think gaming platforms needing age verification or DAOs enforcing one-person-one-vote governance rules. By minimizing unnecessary data exposure while still meeting compliance requirements, SSI wallets represent a leap forward in both security and user empowerment.

The Business Case: Efficiency Gains for Platforms

The impact extends beyond individual users. For businesses building in Web3, from DeFi protocols to NFT marketplaces, the adoption of encrypted KYC wallets slashes onboarding times and reduces compliance overhead dramatically. According to recent market analyses, companies implementing reusable credentials have reported significant drops in audit costs while accelerating customer acquisition cycles.

- Interoperability: Credentials can be used across different blockchains and dApps without fragmentation.

- Security: Sensitive documents remain encrypted within the wallet; only proofs are shared with third parties.

- Simplified Audits: Compliance teams can verify cryptographic attestations instantly rather than sifting through paperwork.

This positions SSI as not just a privacy win but also a strategic advantage for organizations seeking scalable onboarding solutions in 2025’s competitive Web3 ecosystem.

Adopting self-sovereign identity wallets is also changing the regulatory landscape. With verifiable credentials and decentralized identity verification, platforms can demonstrate robust compliance while maintaining user privacy. This is especially relevant as regulators increasingly scrutinize both centralized and decentralized exchanges for KYC/AML adherence. SSI wallets create a transparent, auditable trail of attestations without the need to store sensitive data in vulnerable silos.

Another key driver for adoption is the rise of cross-platform digital identity management. As users move between DeFi protocols, NFT marketplaces, gaming ecosystems, and DAOs, they no longer need to repeat verification steps or risk exposing their personal data repeatedly. Instead, one set of reusable credentials can unlock seamless access across the entire Web3 landscape. This not only accelerates onboarding but also fosters a more connected and user-centric ecosystem.

Real-World Impact: Use Cases and Emerging Networks

The practical impact of SSI wallets is already visible in several areas:

- DeFi Onboarding: Users can instantly access multiple lending, trading, or staking platforms with a single KYC credential. Platforms like Cheqd and Altme are pioneering this approach to make DeFi more accessible and compliant.

- Metaverse Identity: Gamers can prove age or region without doxxing their real-world identities, protecting privacy while enabling fair play and regulatory alignment.

- DAO Governance: SSI credentials enable one-person-one-vote systems by linking verified identities to wallet addresses, preventing Sybil attacks without centralizing control.

The emergence of networks like idOS further illustrates how decentralized identity infrastructure is enabling privacy-preserving digital identity at scale. These networks act as neutral layers for issuing, storing, and verifying credentials that are portable across chains and applications.

What’s Next: The Road to Universal Reusable KYC

The vision for 2025 and beyond is clear: a “verify once, reuse everywhere” model where users own their digital footprint while platforms reduce friction and cost. As more dApps integrate with SSI standards, we will see an acceleration in adoption, fueled by growing demand for privacy-preserving solutions that don’t compromise compliance or user experience.

If you’re looking to understand how these trends directly impact your project or portfolio, explore our in-depth resources on reusable KYC in decentralized identity wallets or discover how portable on-chain identity solves KYC fatigue in DeFi.

The bottom line? Self-sovereign identity wallets are rapidly becoming essential tools for anyone navigating the next phase of Web3, offering a rare combination of privacy, security, interoperability, and regulatory compliance. By eliminating repetitive KYC through reusable credentials, they pave the way for a future where digital onboarding is truly user-first.