In 2025, self-sovereign identity wallets are fundamentally reshaping how online Know Your Customer (KYC) processes operate. Traditional KYC has long been a pain point for users and organizations alike, forcing individuals to repeatedly submit sensitive documents to myriad platforms, with each interaction increasing the risk of data breaches and privacy erosion. The rise of decentralized, user-controlled digital identity solutions marks a clear departure from these legacy systems, offering a glimpse into a future where individuals own and manage their credentials securely.

From Repetitive KYC to One-Time Verification

One of the most significant transformations brought by self-sovereign identity (SSI) wallets is the shift from repetitive, siloed KYC checks to a one-time verification model. Instead of re-uploading passports or utility bills for every new service, users can now store verifiable credentials, such as government-issued IDs or proof of address, within their SSI wallet. When onboarding with a new platform, they simply grant access to the relevant credential, enabling instant verification.

This approach dramatically improves both efficiency and user experience. According to recent industry reports, SSI-enabled reusable KYC reduces onboarding times from days to minutes while minimizing friction across Web3 and traditional finance applications. For an in-depth look at how reusable KYC works in practice, see our guide on one-time KYC for reusable Web3 access.

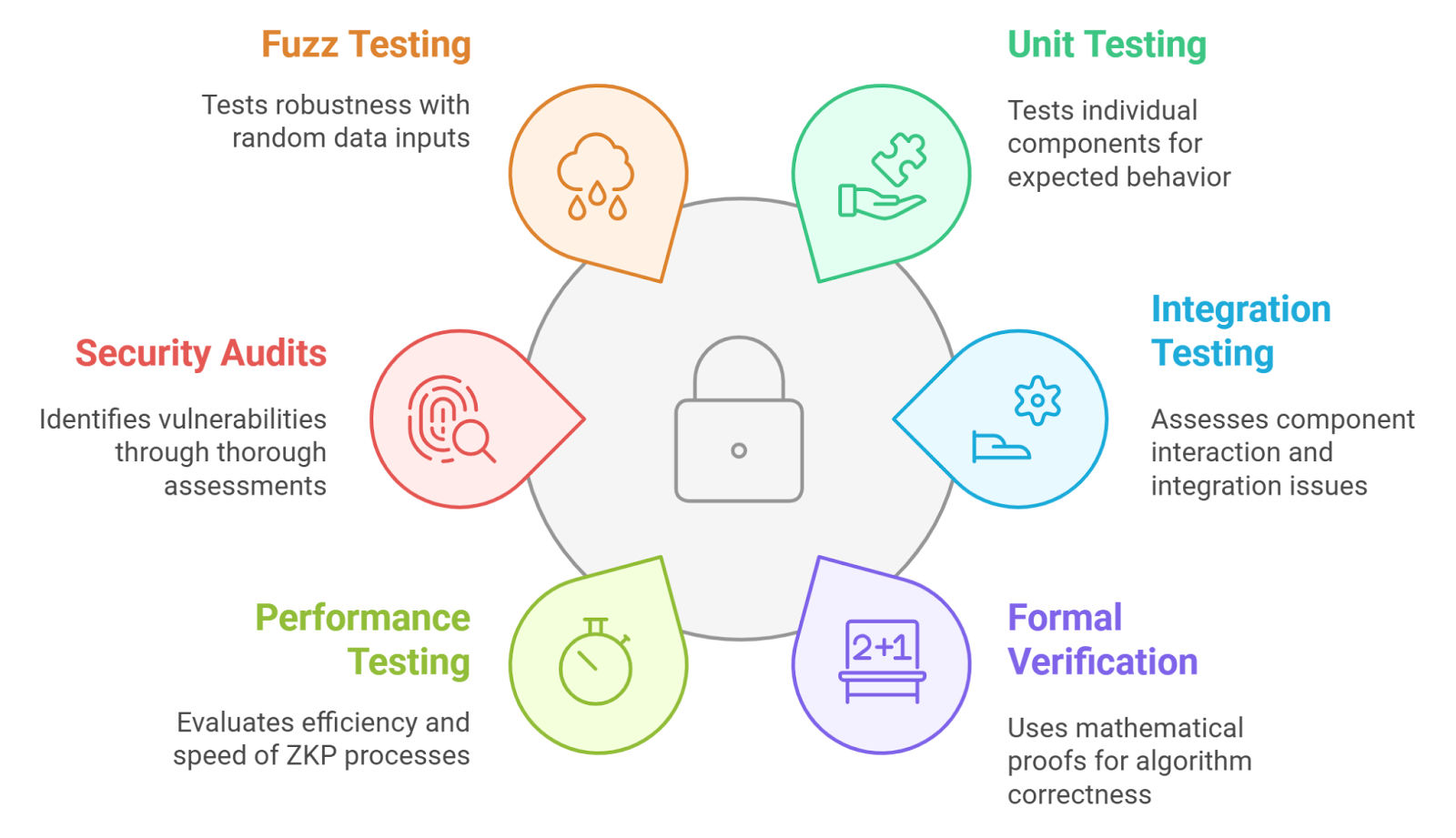

Enhanced Privacy Through Zero-Knowledge Proofs

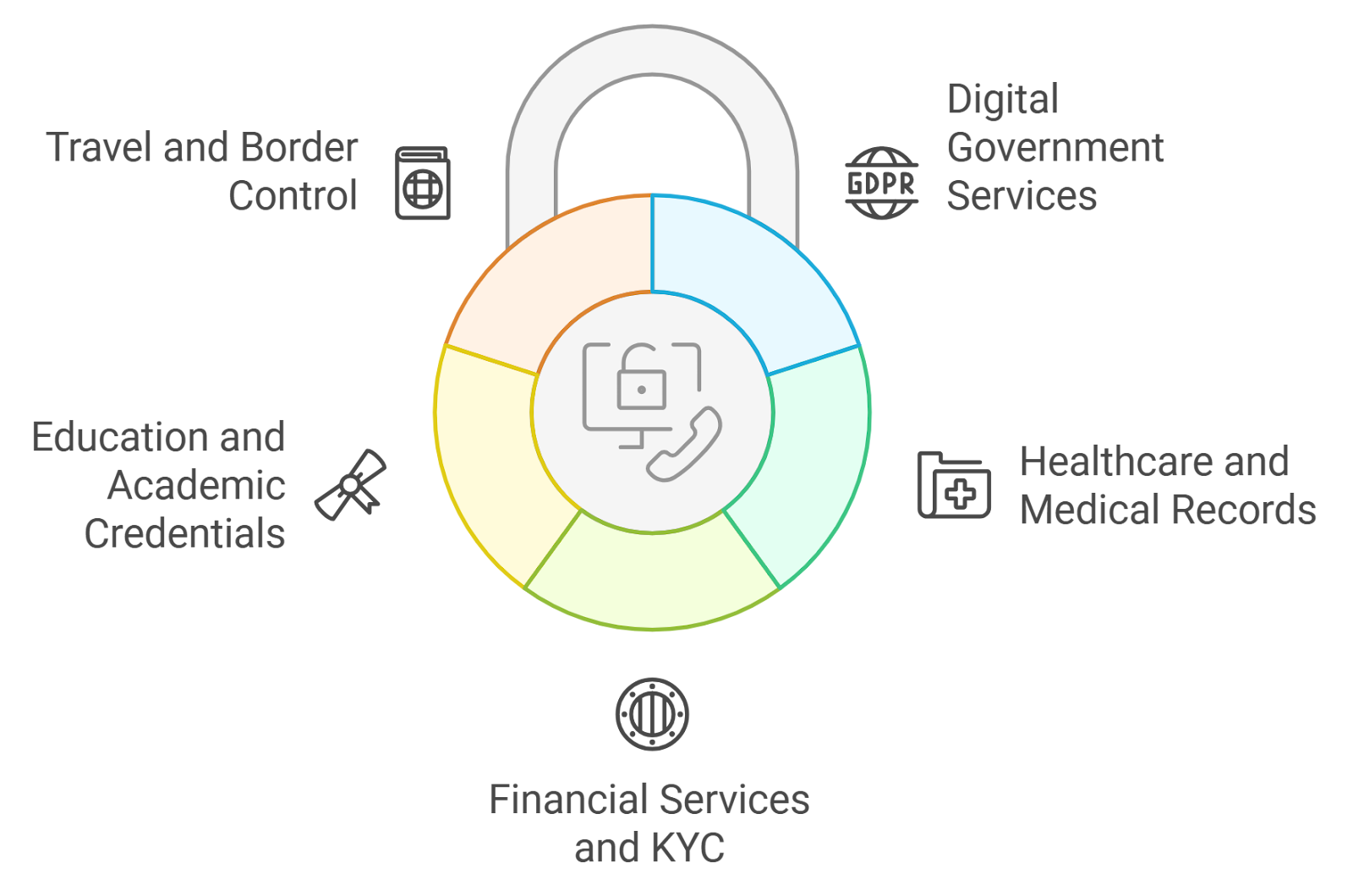

The privacy advantages of SSI wallets are not just incremental, they are transformative. By leveraging zero-knowledge proofs (ZKPs), users can prove facts about their identity without revealing the underlying data. For example, you might confirm you are over 18 or reside in a specific country without exposing your date of birth or full address. This granular disclosure stands in stark contrast to legacy systems that often require oversharing personal details.

A notable case is Privado ID’s use of ZKPs for digital onboarding: service providers can validate essential user attributes while remaining blind to all unnecessary information. As regulatory scrutiny around data minimization intensifies globally, SSI wallets’ privacy-preserving architecture is increasingly seen as both a compliance enabler and a competitive differentiator.

The Security Paradigm Shift: Decentralization Over Centralization

The security risks associated with centralized databases have become glaringly apparent over the last decade. High-profile breaches have exposed millions of identities due to single points of failure inherent in traditional KYC repositories. In contrast, SSI wallets decentralize control by allowing individuals, not corporations, to store and manage their own digital credentials.

This paradigm shift means that even if one service provider is compromised, the attacker gains no access to other platforms or unrelated credentials. By removing honeypots of personal data and empowering users with cryptographically secured wallets, the attack surface shrinks dramatically.

If you’re interested in how portable on-chain identity addresses these challenges across DeFi and Web3 apps specifically, explore our analysis on solving KYC fatigue in decentralized applications.

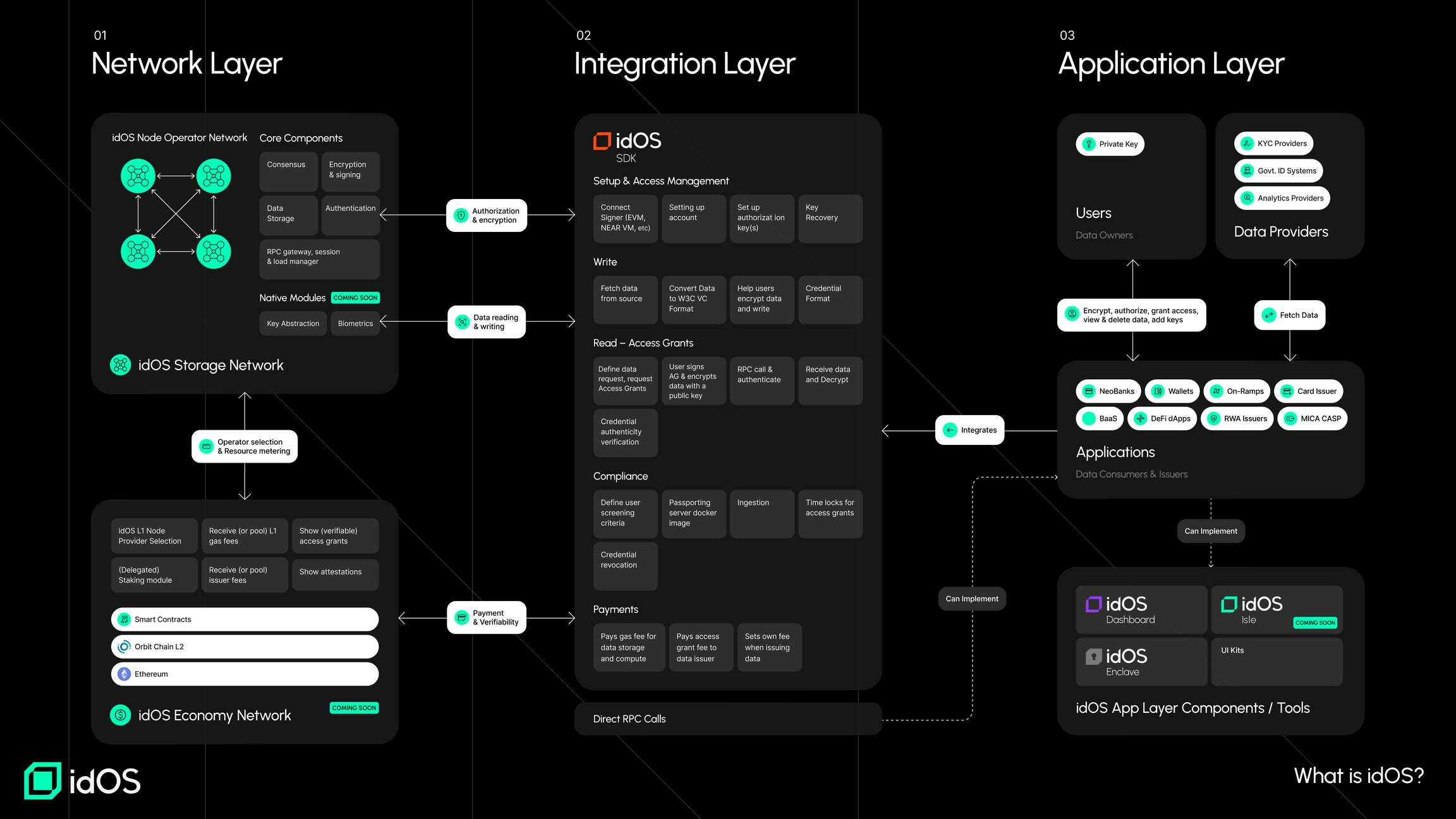

Interoperability and the Rise of Portable KYC

Beyond privacy and security, interoperability is a defining advantage of self-sovereign identity wallets in 2025. Unlike legacy systems where each platform maintains its own siloed user database, SSI credentials can be verified and reused across multiple services, whether in DeFi, traditional finance, or government portals. This portability slashes onboarding times and eliminates the frustration of redundant verification procedures. For example, the idOS Network allows users to maintain a single set of verifiable credentials, which can be leveraged for instant onboarding across diverse ecosystems without resubmitting documentation or enduring repeated manual reviews.

This trend toward portable KYC is already reshaping compliance workflows for exchanges, fintechs, and even public sector agencies. The outcome is a more connected digital economy where individuals retain sovereignty over their data while organizations benefit from faster, lower-risk customer acquisition. For further insights into how wallet-linked reusable IDs are streamlining both TradFi and DeFi onboarding, see our resource on wallet-linked reusable IDs.

Market Growth Signals Mainstream Adoption

The momentum behind decentralized KYC solutions in 2025 is unmistakable. According to recent projections, the SSI wallet market is on track to achieve a compound annual growth rate (CAGR) of 28.7% from 2025 to 2033, reaching an estimated size of $11.14 billion by 2033. This explosive growth reflects not only the increasing demand for privacy-preserving digital credentials but also the expanding universe of applications requiring trusted online verification.

Enterprises are racing to integrate DID wallet online verification as regulatory expectations shift toward user-centric models that prioritize consent and data minimization. Meanwhile, privacy advocates champion these tools as essential infrastructure for Web3 identity management, enabling individuals to participate in digital economies without surrendering control over their personal information.

Top 5 Benefits of SSI Wallets for Online KYC

-

Enhanced Privacy & Security: SSI wallets empower users to control their own identity data, minimizing exposure to centralized data breaches. Technologies like Zero-Knowledge Proofs (ZKPs)—used by platforms such as Privado ID—enable verification without revealing sensitive personal details.

-

Regulatory Compliance: By giving individuals granular control over their data, SSI wallets facilitate compliance with global regulations like GDPR and CCPA. This ensures data minimization and explicit user consent, aligning with evolving legal standards.

-

Seamless Interoperability: SSI wallets, such as those leveraging the idOS Network, allow users to reuse verified credentials across multiple platforms. This eliminates redundant KYC checks and streamlines onboarding processes.

-

User-Centric Experience: SSI wallets enable selective disclosure of information, so users only share what’s necessary. This user-first approach enhances trust and convenience during digital onboarding.

-

Rapid Market Growth & Adoption: The SSI wallet market is projected to grow at a 28.7% CAGR from 2025 to 2033, reaching $11.14 billion by 2033. This surge reflects increasing demand for secure, user-controlled identity solutions.

Challenges and What’s Next

No technological revolution is without its hurdles. While SSI wallets offer clear advantages in terms of control and privacy, challenges remain around user education, standardization across jurisdictions, and seamless integration with legacy systems. Regulatory frameworks are evolving rapidly but still require harmonization to support cross-border use cases at scale.

Yet the direction is clear: as zero-knowledge technology matures and interoperability standards solidify, self-sovereign identity wallets will become foundational for secure digital interactions, from finance to healthcare to government services. The next wave will likely see even broader adoption as organizations realize that empowering users with privacy-preserving digital credentials isn’t just good ethics, it’s good business.

If you want to dive deeper into how reusable KYC credentials are solving compliance and privacy challenges in Web3 today, check out our deep-dive analysis on reusable KYC in decentralized identity wallets.