Reusable decentralized identity (DID) wallets are rapidly redefining the landscape of onchain KYC and Web3 banking. These wallets empower users to securely store and reuse verified credentials across multiple platforms, eliminating the inefficiency and privacy risks of repeatedly submitting sensitive information. In a world where digital onboarding friction is a major barrier, reusable decentralized identity wallets are emerging as a cornerstone for seamless, privacy-preserving, and compliant user experiences.

Why Traditional KYC Is Broken in Web3

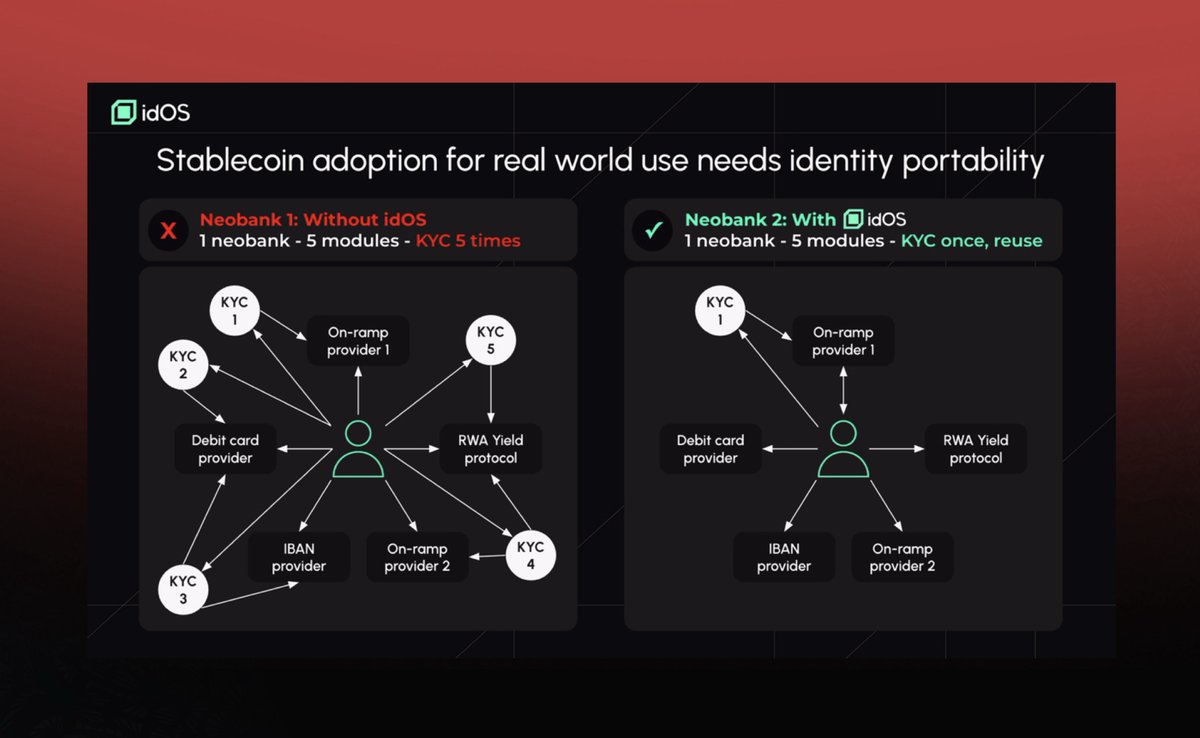

Legacy KYC processes were designed for siloed, centralized systems. Each new platform or financial service demands users upload sensitive documents and undergo verification from scratch. This approach is not only frustratingly redundant for users, but it also increases the risk of data breaches as personal information is scattered across multiple databases. For Web3 banking and stablecoin onboarding, these inefficiencies are particularly acute, slowing adoption and raising compliance costs for projects.

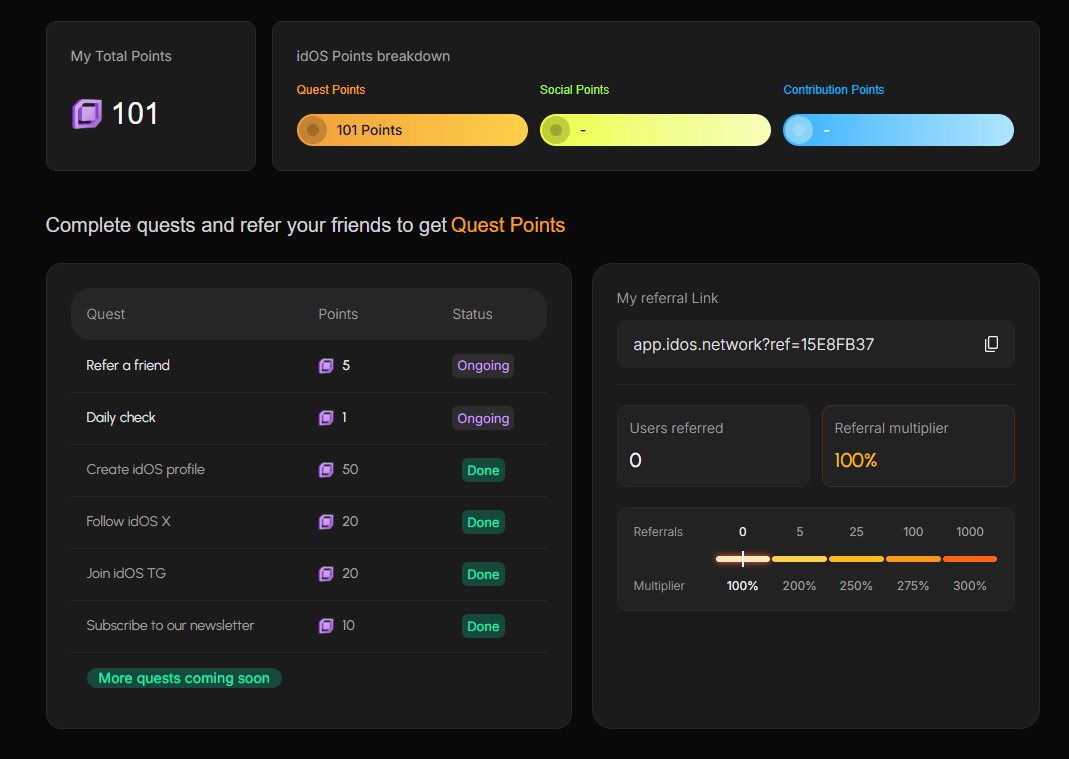

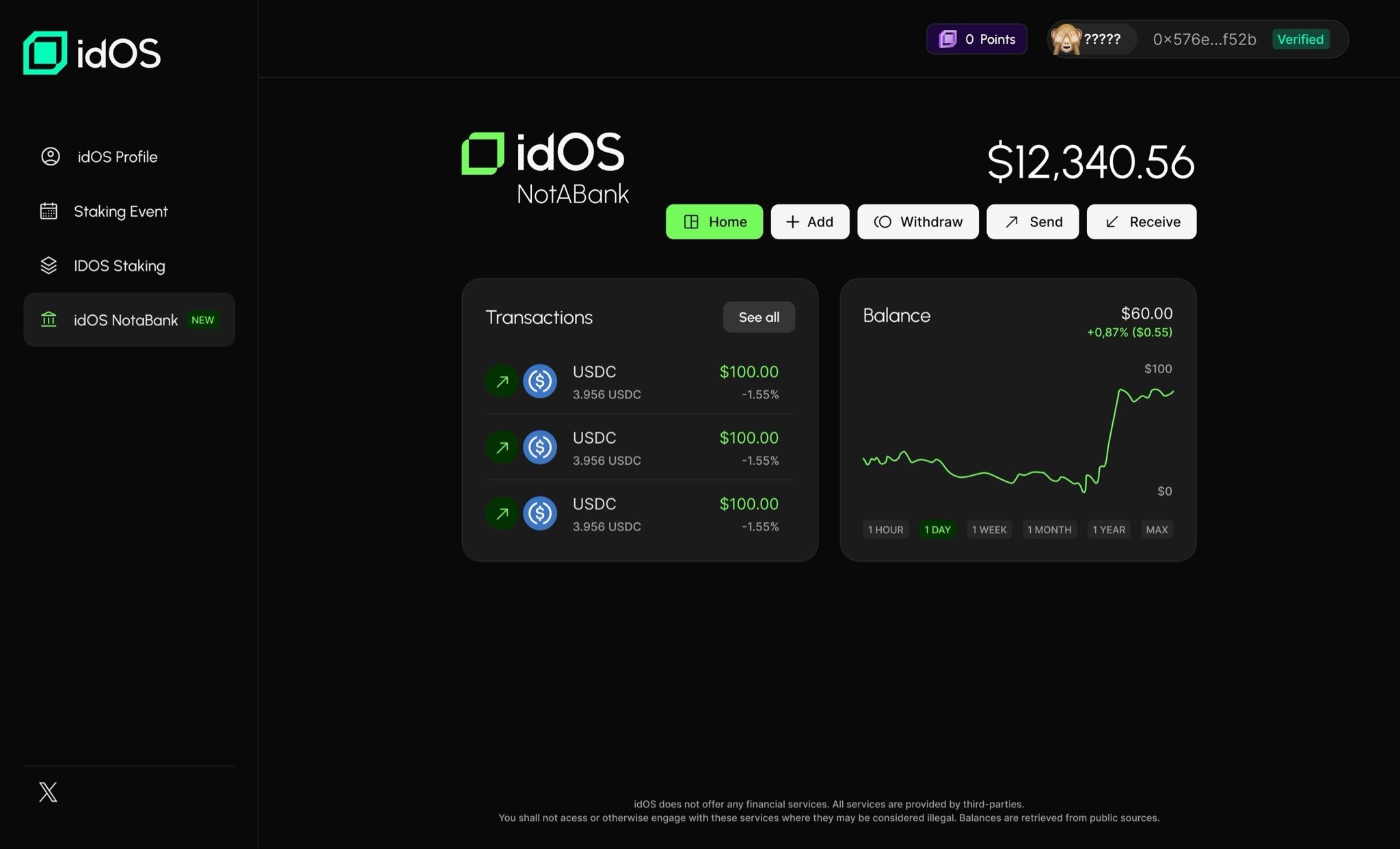

Enter reusable decentralized identity: With DID wallets, users can complete KYC once, store their credentials securely, and present them as needed across a growing ecosystem of dApps and financial services. The idOS Network is a leading example, providing an open identity layer for Web3 that allows users to verify once and transact everywhere. As noted in the idOS documentation, this model reduces onboarding friction for stablecoin platforms, neobanks, and fintechs, while letting users retain control of their data.

How Reusable DID Wallets Work: Privacy by Design

At the core of reusable decentralized identity wallets is the principle of self-sovereign identity. Users own their portable digital ID, stored cryptographically in their wallet. When a platform requests KYC, the user can present a verifiable credential issued by a trusted authority. Critically, advanced cryptography like zero-knowledge proofs (zk) enables users to prove they meet requirements (such as being over 18 or not on a sanctions list) without exposing underlying personal data.

Solutions like zkMe’s zkKYC and the idOS Network leverage these technologies to deliver privacy-preserving KYC that satisfies regulatory demands without sacrificing user autonomy. This approach not only improves compliance but also significantly reduces the risk of mass data breaches. Users share only what’s necessary, when it’s necessary.

Top Benefits of Reusable Decentralized Identity Wallets in Web3 Banking

-

Single KYC, Multiple Platforms: Complete identity verification once and reuse your credentials across various Web3 apps and services, eliminating repetitive onboarding. (e.g., idOS Network, zkMe’s zkKYC)

-

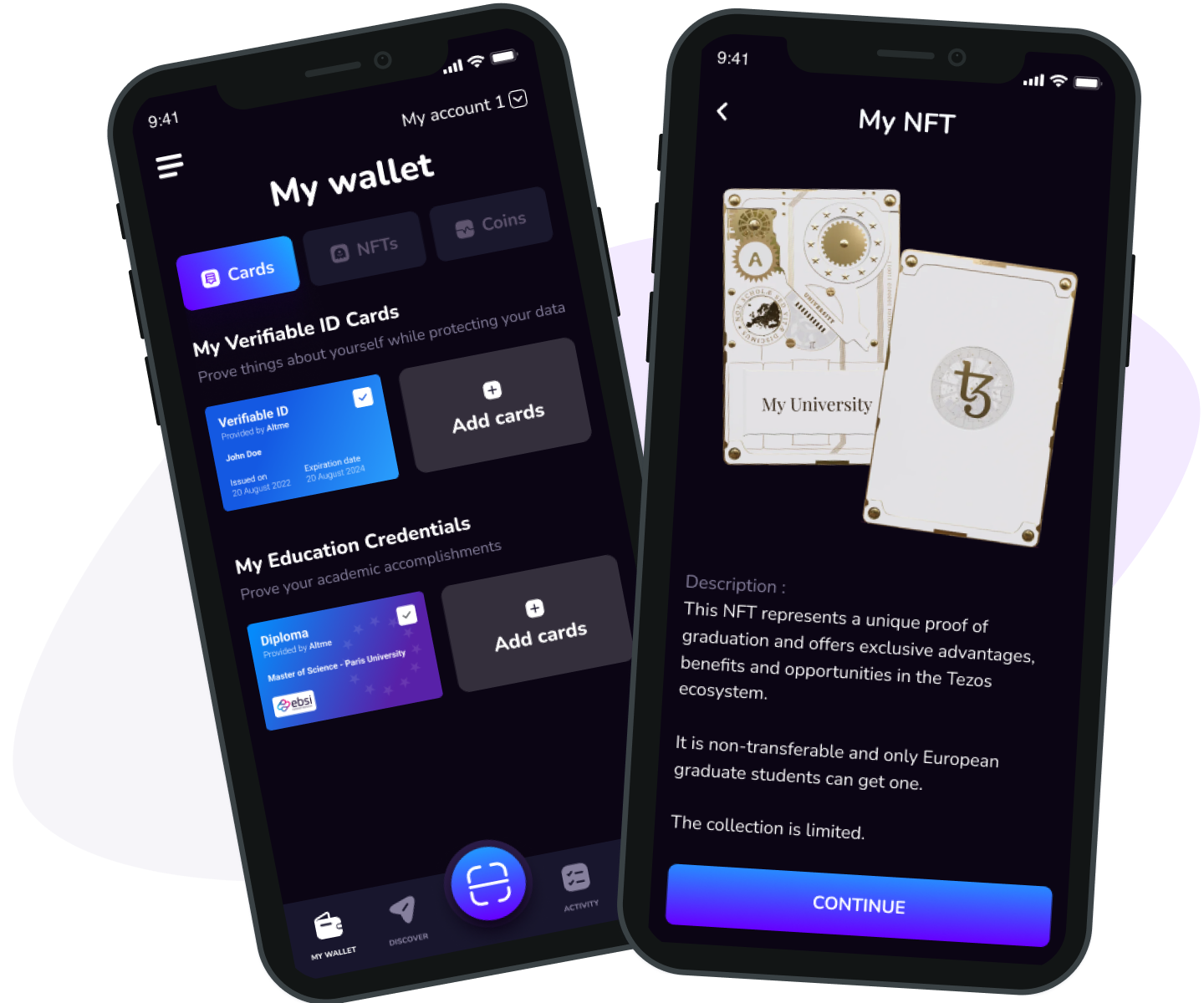

User-Controlled Data Privacy: Maintain full control over your personal information, sharing only what is necessary with each service and reducing the risk of data breaches. (e.g., Altme decentralized identity wallet)

-

Enhanced Security with Zero-Knowledge Proofs: Prove your identity or attributes (like age) without revealing sensitive details, thanks to advanced cryptography. (e.g., zkMe zero-knowledge KYC process)

-

Faster and Cheaper Onboarding: Streamline user onboarding for banks, stablecoin platforms, and fintechs, cutting operational costs and saving time. (e.g., Transak and Privado ID integration)

-

Regulatory Compliance Made Simple: Meet global KYC and AML requirements easily while preserving user privacy, supporting compliant growth in the Web3 ecosystem. (e.g., idOS compliance solutions for stablecoins)

Real-World Adoption: From Stablecoin Onboarding to Web3 Neobanks

The shift toward reusable onchain KYC wallets is not theoretical – it’s already underway. The idOS Network, for example, is being integrated by stablecoin platforms and neobanks to offer seamless user onboarding and reusable KYC. Once users verify their identity, they can immediately access a range of compliant financial services without repeating the process. This model is also being adopted by projects like Transak and Privado ID, who have joined forces to enable users to complete KYC once and reuse the credential across multiple services (Transak blog).

The result? Reduced onboarding times, lower operational costs for platforms, and a user experience that aligns with the privacy-first ethos of Web3.

Beyond streamlined onboarding, reusable decentralized identity wallets unlock new models for digital trust and compliance in Web3 banking. Projects like Altme are pushing the boundaries, offering on-chain compliance tools that let users prove attributes such as age or residency without leaking unnecessary information (Altme blog). This granular control over data sharing is a sharp departure from legacy KYC, where platforms often hoard more information than they need, increasing systemic risk.

Risks, Challenges, and What Comes Next

While the benefits are clear, several challenges remain on the road to universal adoption of reusable decentralized identity wallets. Interoperability between different DID standards, regulatory acceptance of cryptographic credentials, and user education are all critical hurdles. For example, some regulators may still prefer traditional document-based verification until decentralized models prove their robustness at scale. Meanwhile, users must be taught how to manage their portable digital IDs securely – a shift from habitual reliance on centralized platforms.

The idOS Network’s open approach is a promising step toward addressing these issues. By acting as a neutral identity layer for multiple dApps and services, it encourages standardization while keeping users in control. As more Web3 neobanks and fintechs integrate reusable KYC frameworks, network effects will drive broader acceptance both among users and regulators.

The Future of Onchain KYC: A User-Centric Paradigm

Ultimately, reusable decentralized identity wallets are poised to become foundational infrastructure for Web3 banking and digital finance. They enable compliance without compromise, letting users move seamlessly between platforms while retaining sovereignty over their data. This shift also aligns with the increasing demand for privacy-preserving solutions as blockchain adoption grows globally.

For stablecoin issuers, neobanks, and DeFi projects, integrating portable digital ID solutions means faster onboarding, lower costs, and enhanced trust with regulators and users alike. The competitive advantage now lies in offering frictionless yet compliant access to financial products – something only possible with robust decentralized identity architecture.

Top Use Cases for Reusable Decentralized Identity Wallets in Web3 Banking & Stablecoin Onboarding

-

Seamless Stablecoin Onboarding Across PlatformsReusable decentralized identity wallets like idOS enable users to complete KYC once and access multiple stablecoin platforms and neobanks without repeated verification, streamlining user onboarding and reducing friction.

-

Privacy-Preserving Onchain KYCSolutions such as zkMe’s zkKYC use zero-knowledge proofs to let users verify their identity without exposing sensitive personal data, enhancing privacy while ensuring regulatory compliance.

-

Cross-Platform Reusable KYC CredentialsBy leveraging reusable KYC credentials through platforms like Transak x Privado ID, users can utilize verified identity data across decentralized exchanges, lending protocols, and wallets, eliminating repetitive onboarding steps.

-

Decentralized Compliance for Web3 BankingPlatforms such as Altme provide on-chain compliance tools using verifiable credentials (e.g., proof of age, proof of identity), helping Web3 banks meet regulations while maintaining user control over data.

-

User-Controlled Data Sharing & Selective DisclosureReusable DID wallets empower users to selectively share only necessary identity attributes (like age or residency) with dApps, reducing data exposure and enhancing security.

As standards mature and ecosystems like idOS Network gain traction, expect reusable onchain KYC wallets to move from cutting-edge to commonplace. The winners will be those who empower users with privacy-first tools while meeting the evolving demands of global compliance.