Decentralized finance (DeFi) has long promised open, borderless access to financial services, but its onboarding experience remains encumbered by legacy Know Your Customer (KYC) processes. In 2025, the emergence of portable KYC and self-sovereign identity solutions is fundamentally transforming how users join and interact with DeFi platforms. The idOS Network stands at the forefront of this shift, offering a reusable identity infrastructure that empowers individuals to verify once and transact everywhere, without sacrificing privacy or control.

From Redundant KYC to Portable Digital Credentials

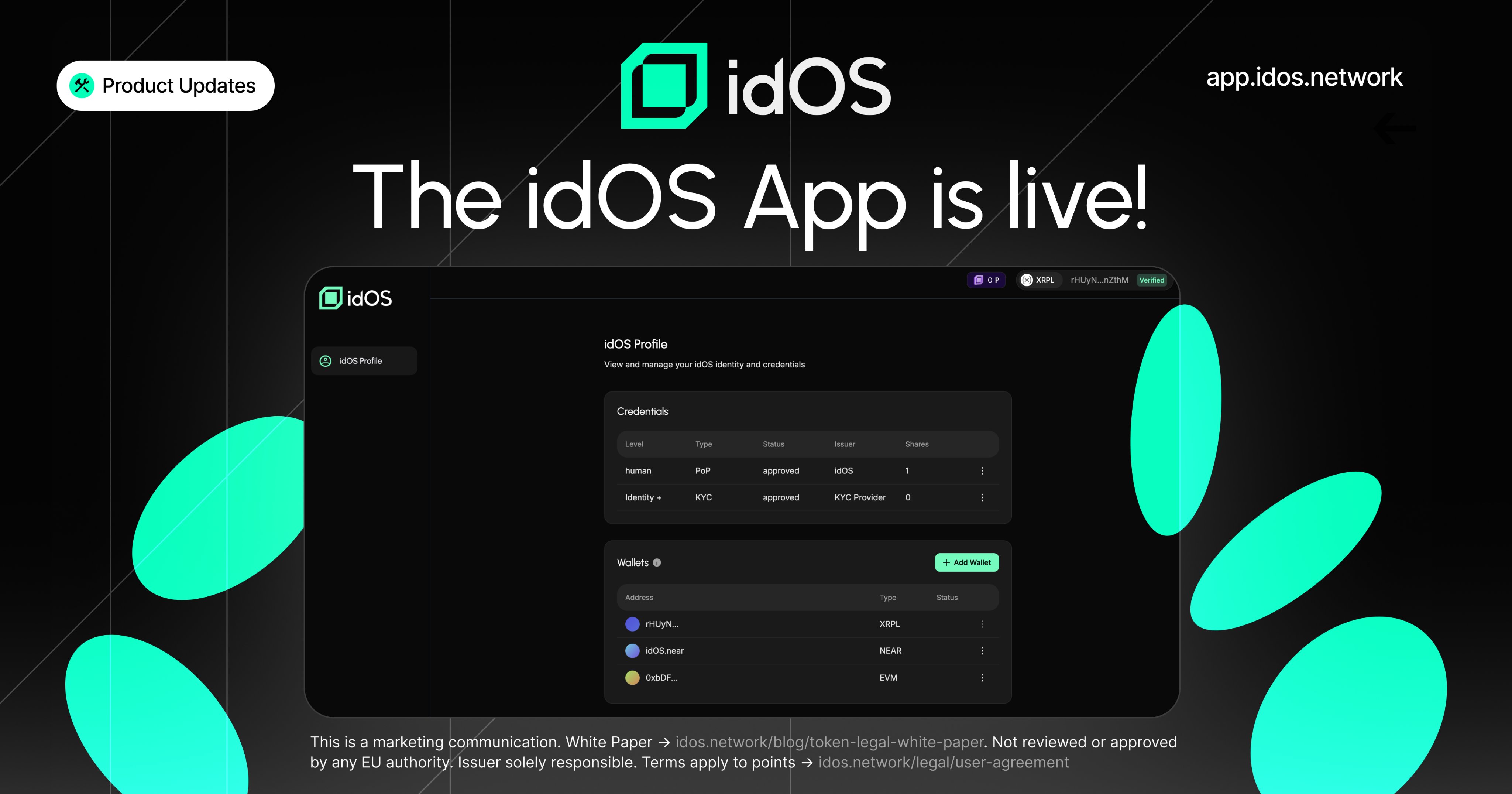

Historically, DeFi onboarding has mirrored traditional finance in one critical aspect: users must repeatedly submit personal documents for KYC verification on every new platform. This not only creates friction and delays but also raises significant privacy concerns as sensitive data is scattered across multiple entities. Portable KYC solutions, led by idOS, disrupt this paradigm by enabling individuals to store their verified credentials in a decentralized identity wallet.

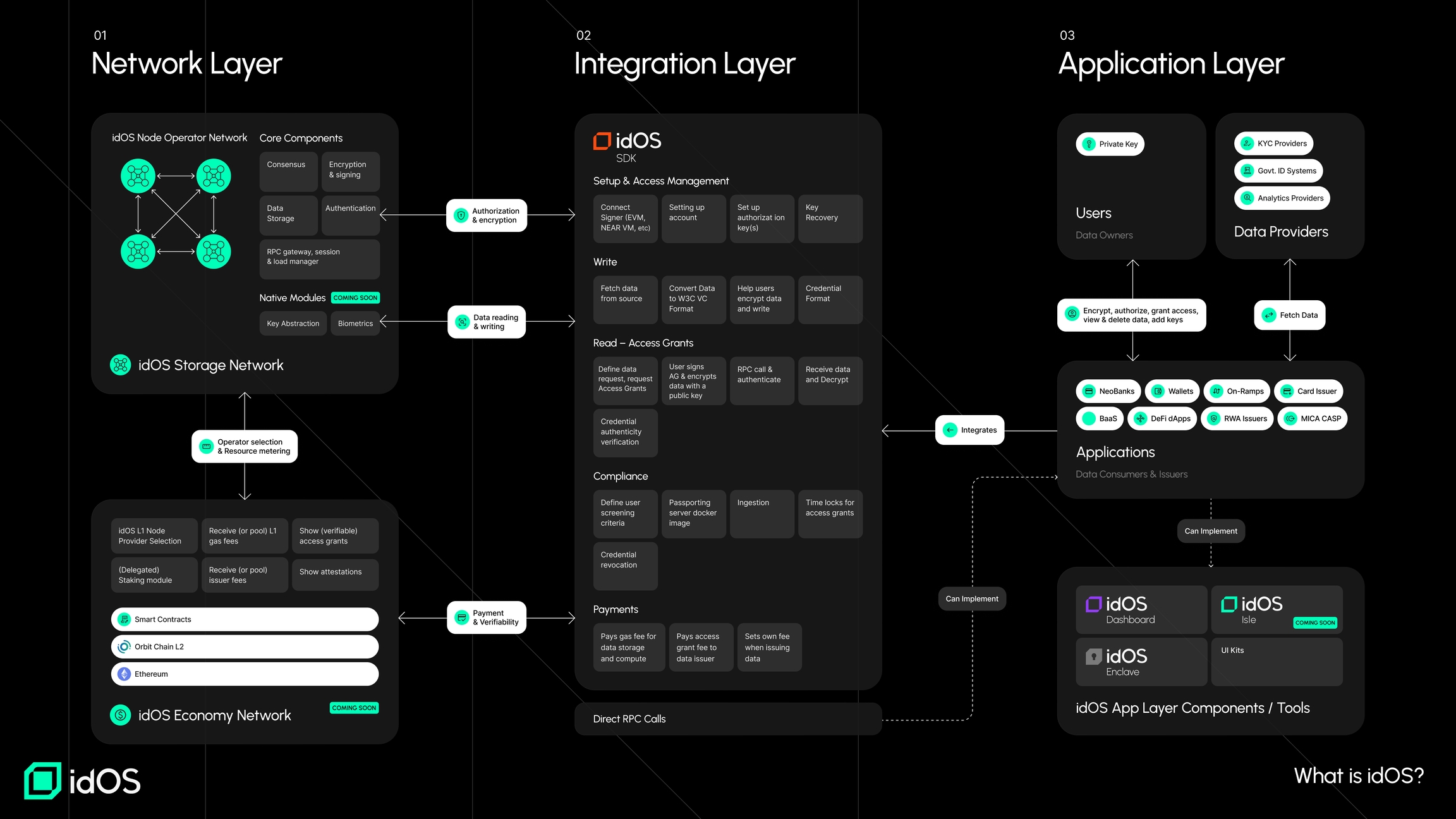

With idOS, users undergo KYC verification just once. Their credentials, encrypted and under their exclusive control, can then be reused across dozens of EVM and non-EVM ecosystems. This approach not only reduces onboarding time but also streamlines compliance for DeFi protocols seeking to adhere to regulatory standards without alienating privacy-focused users. For a comprehensive explanation of the technology underpinning idOS’s portable KYC, see the official documentation.

The Self-Sovereign Identity Advantage

Self-sovereign identity (SSI) is the principle that individuals should own and control their digital identities without reliance on centralized authorities. In the context of DeFi, SSI means users can manage access to their credentials, revoke permissions at will, and decide exactly what information to share with each application. The idOS Network realizes this vision by providing an open-source, chain-agnostic infrastructure for secure storage and cross-chain identity management.

This self-custodial model addresses longstanding concerns about data breaches and misuse of personal information in both Web2 and Web3 environments. Unlike siloed solutions where platforms retain user data indefinitely, idOS lets individuals determine who accesses their credentials, and for how long, while keeping all information encrypted on decentralized infrastructure.

Top Benefits of Portable KYC and Self-Sovereign Identity in DeFi

-

One-Time Verification, Universal Access: Users can verify their identity once and seamlessly access multiple DeFi platforms, eliminating repetitive KYC processes and accelerating onboarding. (Powered by idOS Network)

-

User-Controlled, Privacy-Preserving Data: With self-sovereign identity, individuals retain full control over their personal data, deciding when and with whom to share their credentials, thus enhancing privacy and reducing data exposure risks.

-

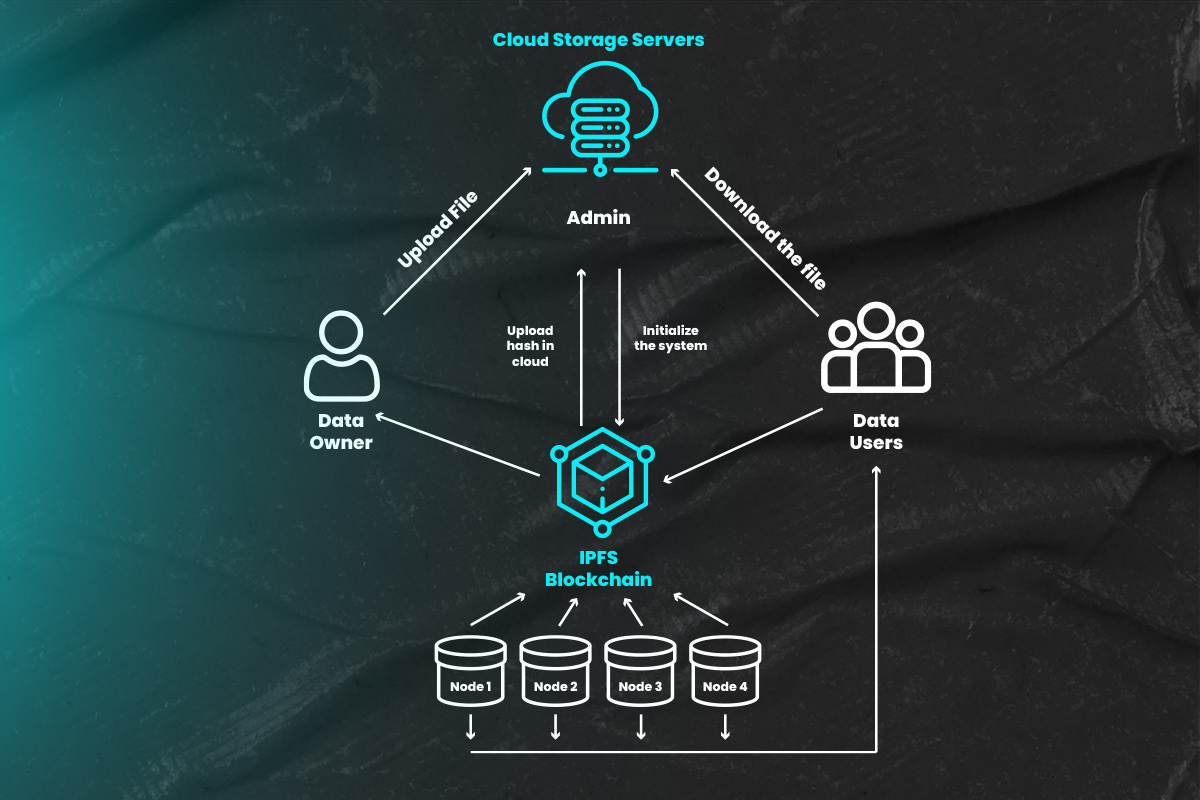

Enhanced Security with Decentralized Storage: Identity data is securely encrypted and stored on decentralized networks like idOS, using advanced cryptographic techniques such as Multi-Party Computation (MPC) to prevent unauthorized access and single points of failure.

-

Streamlined Compliance for DeFi Platforms: DeFi applications can quickly and reliably onboard users while maintaining regulatory compliance, thanks to auditable and privacy-preserving KYC verification provided by idOS.

-

Interoperability Across Ecosystems: idOS enables portable identity use across 40+ EVM and non-EVM blockchains, fostering a more interconnected and accessible DeFi landscape for users worldwide.

Privacy-Preserving Compliance with Advanced Cryptography

Skeptics often question whether decentralized identity systems can meet regulatory requirements without compromising user privacy. The idOS Network answers this challenge through advanced cryptographic techniques such as Multi-Party Computation (MPC). By distributing private key computations across multiple nodes, MPC ensures no single party ever holds complete access to a user’s data or keys, a crucial safeguard against both internal abuse and external attacks.

This architecture not only enhances security but also provides auditable proof of compliance with KYC/AML regulations, without exposing raw personal data to service providers. As a result, platforms integrating idOS can offer one-click onboarding that is both privacy-preserving and regulator-friendly, a rare combination in today’s digital asset landscape. For further reading on the technical aspects of this approach, visit the idOS blog.

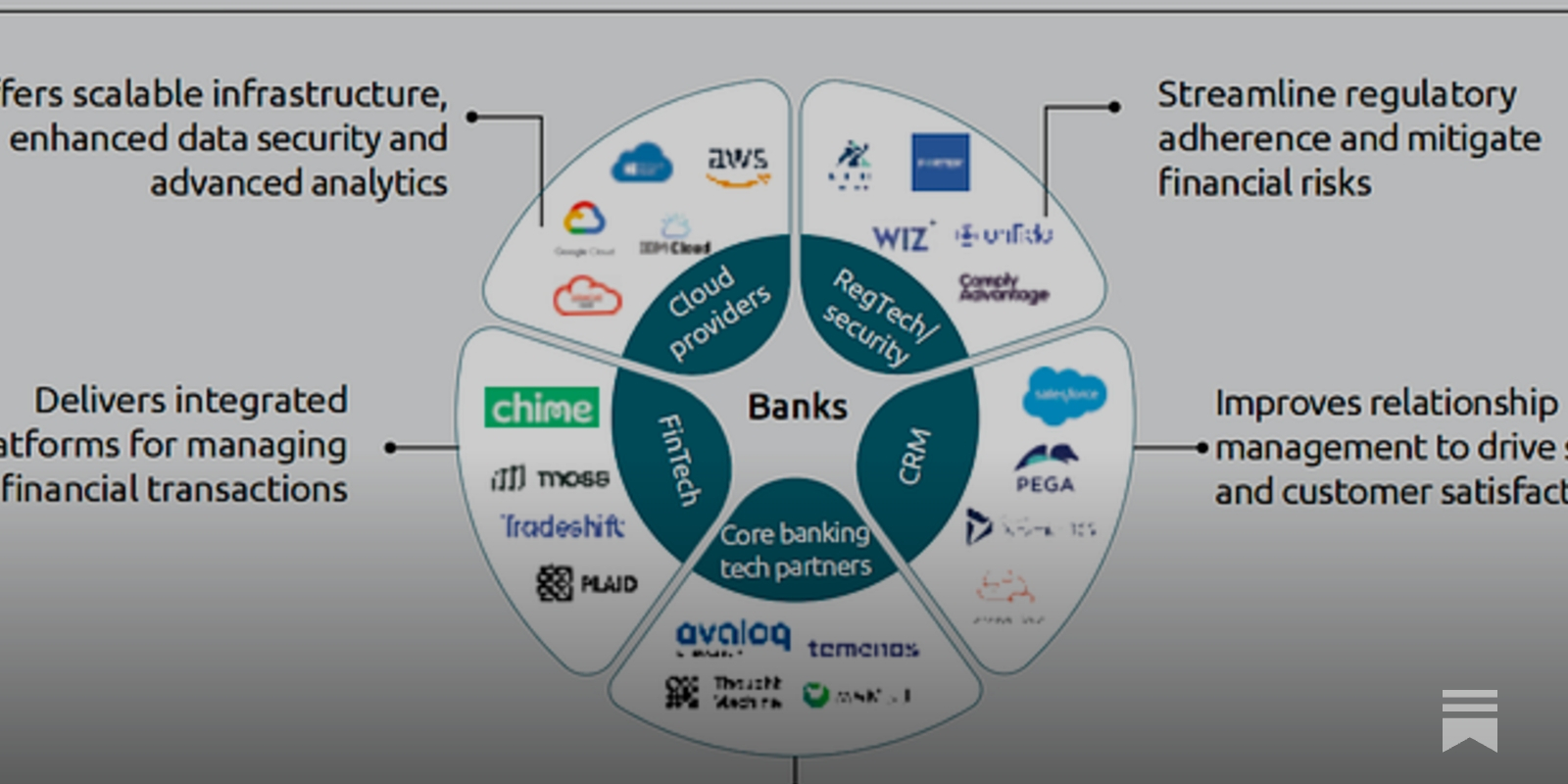

Interoperability is a cornerstone of the idOS Network’s value proposition. By supporting both EVM and non-EVM ecosystems, idOS ensures that users’ decentralized identity wallets are portable across more than 40 blockchain environments. This cross-chain compatibility is essential for a truly borderless DeFi experience, where users can seamlessly interact with lending protocols, stablecoin issuers, and NFT marketplaces using the same reusable digital credentials.

The implications for developers are equally significant. Integrating idOS into a DeFi application not only accelerates onboarding but also reduces the compliance burden. Rather than building bespoke KYC solutions for every jurisdiction or user segment, projects can leverage idOS’s chain-agnostic infrastructure and focus on delivering innovative financial products. This modular approach fosters greater ecosystem growth and enables smaller teams to compete on a level playing field with established platforms.

Economic Incentives and User Empowerment

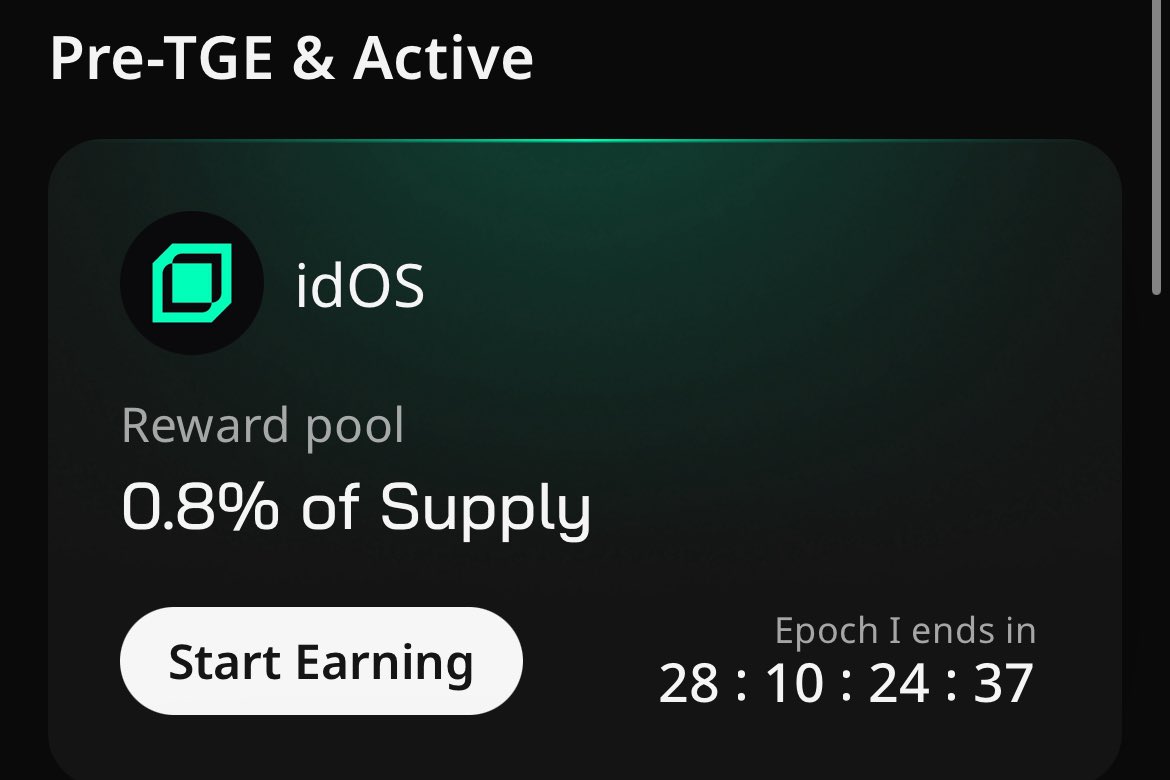

Beyond privacy and convenience, idOS introduces novel economic incentives for end users. In certain implementations, individuals may share in access-grant revenue when their verified credentials are used by third-party services, turning portable KYC from a compliance cost into a potential source of income. This model aligns incentives between users, platforms, and identity verifiers, fostering more transparent and equitable digital economies.

The self-custodial nature of idOS also means that users are not locked into any single provider or ecosystem. Should they wish to revoke access or migrate their data elsewhere, they retain full autonomy at all times, an essential feature as regulatory landscapes evolve or new risks emerge.

Top Use Cases for Portable KYC & Self-Sovereign Identity in DeFi

-

Seamless Multi-Platform Onboarding: Portable KYC via idOS Network enables users to verify their identity once and access multiple DeFi platforms without repeated KYC submissions, streamlining entry into the ecosystem.

-

Privacy-Preserving Stablecoin Transactions: With self-sovereign identity, users can transact with stablecoins across various protocols while retaining control over their personal data, enhancing privacy and usability in the stablecoin economy.

-

Cross-Chain Identity Portability: idOS supports identity management across 40+ EVM and non-EVM blockchains, allowing users to interact with diverse DeFi applications using a single, secure digital identity.

-

Regulatory Compliance for DeFi Protocols: DeFi platforms can leverage portable KYC to meet global regulatory requirements efficiently, using tamper-proof, auditable credentials while minimizing user friction.

-

User-Controlled Data Monetization: Self-sovereign identity frameworks like idOS allow users to grant access to their verified credentials and potentially share in access-grant revenue, creating new incentives for data ownership.

-

Enhanced Security with Decentralized Storage: Advanced cryptographic techniques such as Multi-Party Computation (MPC) in idOS ensure that identity data is encrypted, decentralized, and protected from single points of failure.

Driving the Next Wave of Web3 Onboarding

The convergence of portable KYC, self-sovereign identity, and advanced cryptography marks a pivotal moment for DeFi onboarding. With the idOS Network’s open-source protocols and privacy-preserving architecture, onboarding becomes not just faster but fundamentally safer and more user-centric.

As regulators increase scrutiny on digital asset markets, solutions like idOS offer a pragmatic path forward, one that satisfies compliance requirements while upholding the core values of decentralization and individual empowerment. The days of repetitive KYC checks and fragmented digital identities are numbered; instead, reusable credentials will underpin an era of frictionless access to financial services worldwide.

For those building or participating in the next generation of DeFi applications, adopting decentralized identity standards such as those pioneered by idOS is no longer optional, it is an imperative for trust, growth, and sustainability in Web3.