In the high-stakes arena of regulated finance, where compliance demands clash with escalating privacy expectations, zk identity wallets emerge as a transformative force. These tools empower users with self-sovereign ID, allowing them to prove regulatory adherence- such as KYC status or accreditation- without exposing sensitive personal data. Drawing from zero-knowledge proofs (ZKPs), this technology addresses the vulnerabilities of traditional identity verification, where centralized data repositories invite breaches and repetitive disclosures erode trust.

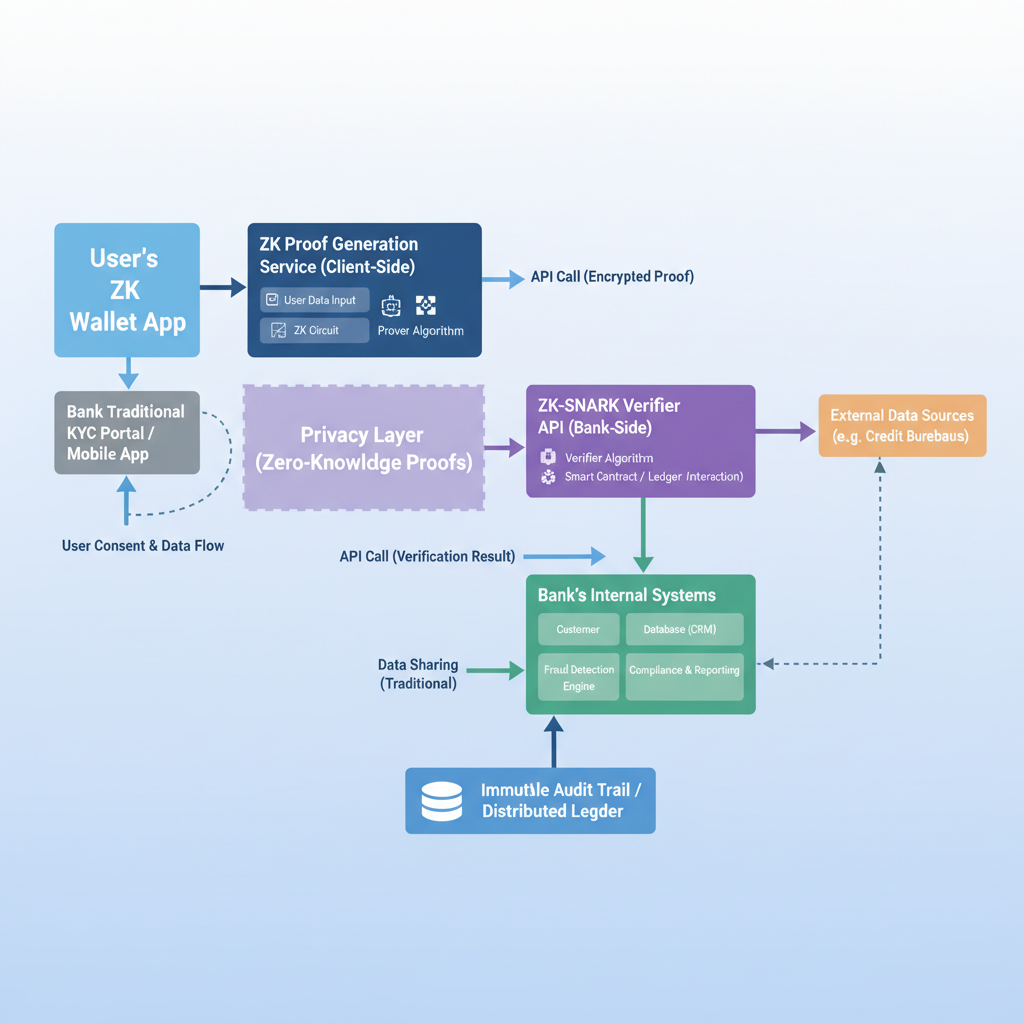

Financial institutions face mounting pressure from frameworks like GDPR and evolving AML/CTF mandates. Conventional KYC processes compel users to resubmit documents across platforms, fostering inefficiency and heightening breach risks. zk identity wallets flip this paradigm, enabling privacy-preserving identity verification through cryptographic attestations. Users hold verifiable credentials in personal wallets, generating proofs that confirm attributes like residency or age without revealing underlying details. This shift not only minimizes data exposure but also aligns with data minimization principles advocated by regulators.

Navigating Regulatory Tensions with ZKPs

Regulators increasingly recognize ZKPs’ potential to reconcile privacy with oversight. As highlighted in discussions from Deutsche Bank and Forbes, self-sovereign identity (SSI) paired with ZKPs facilitates verifiable credentials that institutions can trust without accessing raw data. Consider a high-net-worth investor seeking DeFi access: instead of uploading passports repeatedly, they issue a ZKP attesting to accreditation status. The verifier gains assurance; the user retains sovereignty.

Key Benefits for Compliance

-

Enhanced Privacy: Prove attributes like age, residency, or accreditation without revealing underlying personal data, aligning with GDPR and privacy laws.

-

Regulatory Compliance: Enables ZK-KYC and AML/CTF verification using zero-knowledge proofs, meeting financial regulations without data exposure.

-

Data Minimization: Share only necessary proofs, achieving unlinkability and unobservability as emphasized by regulatory needs.

-

Reduced Breach Risk: Eliminates centralized storage and repetitive data sharing, minimizing risks of hacks and leaks.

-

User Sovereignty: Self-sovereign identity (SSI) gives individuals control via personal wallets and verifiable credentials.

-

Efficient Verification: Streamlines processes with cryptographic attestations, balancing privacy and institutional trust.

Yet, risks persist. Implementation demands robust key management to prevent wallet compromises, and interoperability across chains remains nascent. From my vantage in fixed income and commodities, where counterparty risk is paramount, I view zk wallets as a risk-mitigating evolution- provided protocols undergo rigorous audits. Platforms must embed unlinkability to thwart correlation attacks, ensuring proofs do not inadvertently link sessions.

Core Mechanics of DID Wallets and Zero-Knowledge KYC

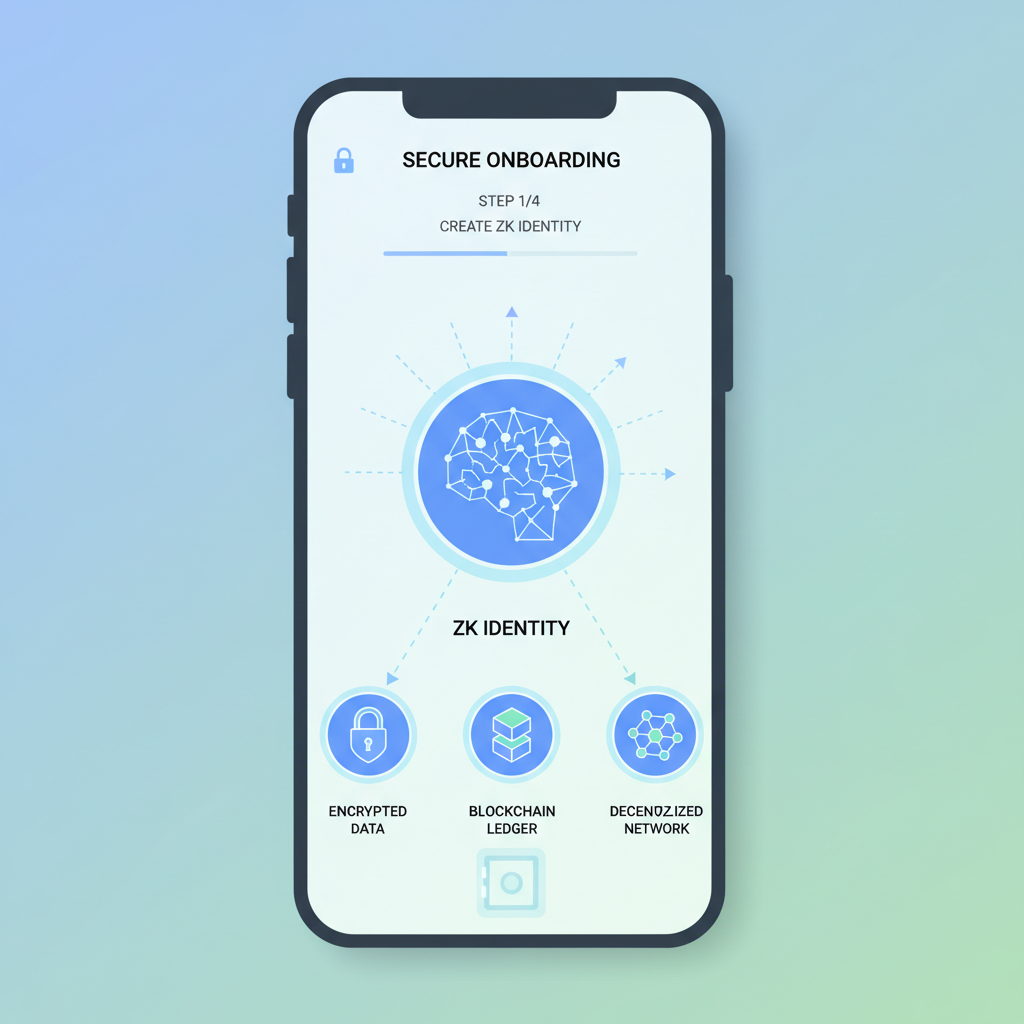

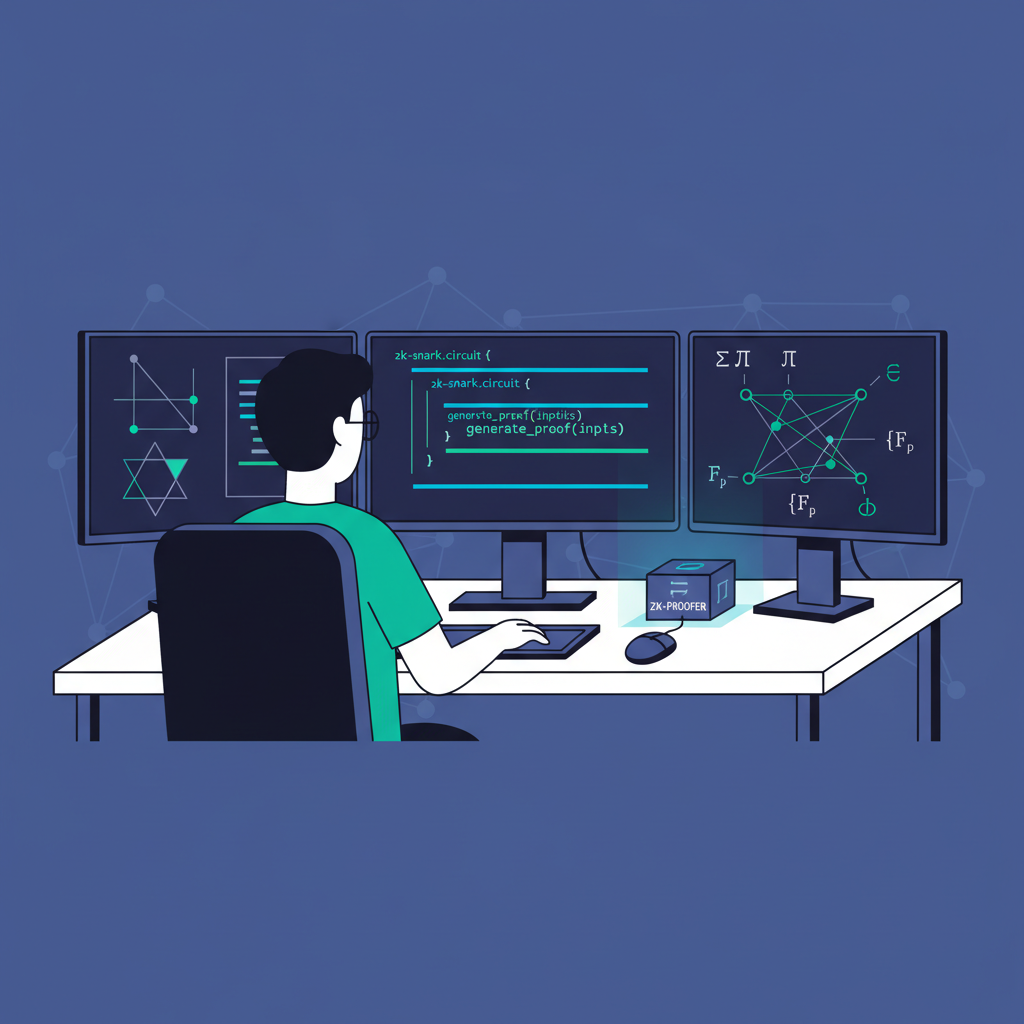

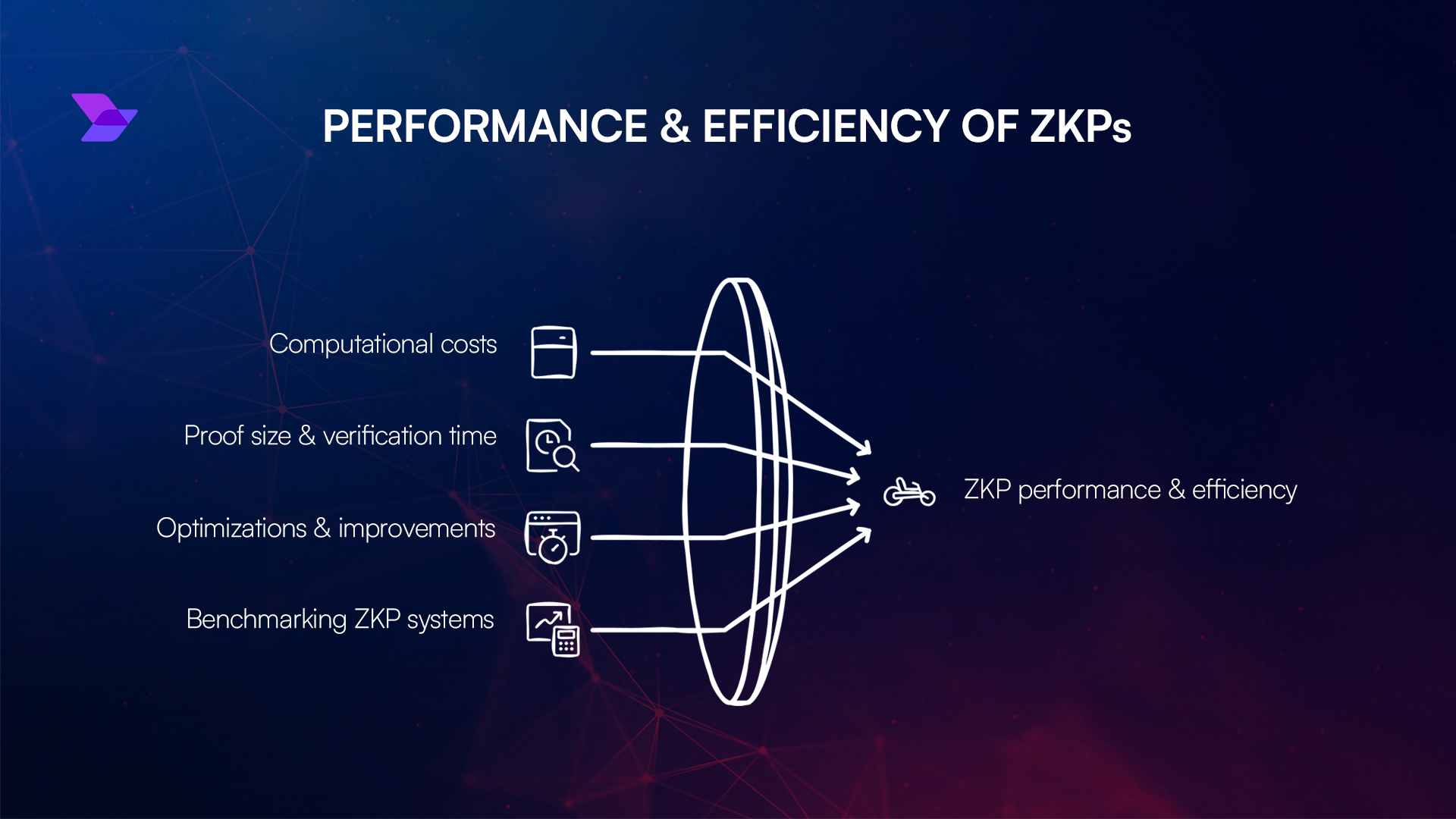

Decentralized identity (DID) wallets serve as the backbone, storing credentials issued by trusted parties- governments, banks, or verifiers. zkKYC extends this by layering ZKPs, mathematically proving statements like “I am over 18 and reside in the EU” without disclosing birthdate or address. Techniques such as zk-SNARKs or zk-STARKs compress proofs for on-chain efficiency, vital for regulated DeFi where transaction scrutiny is intense.

Zero-knowledge proofs are a tool that DID providers can use to further privacy and security, attesting user data was accessed correctly.

In practice, a user downloads a wallet, receives a credential via peer DID, and generates proofs on-demand. This user-centric model reduces reliance on intermediaries, curbing systemic risks from data silos. However, institutions must calibrate acceptance thresholds; over-reliance on unproven circuits could invite regulatory scrutiny or false positives.

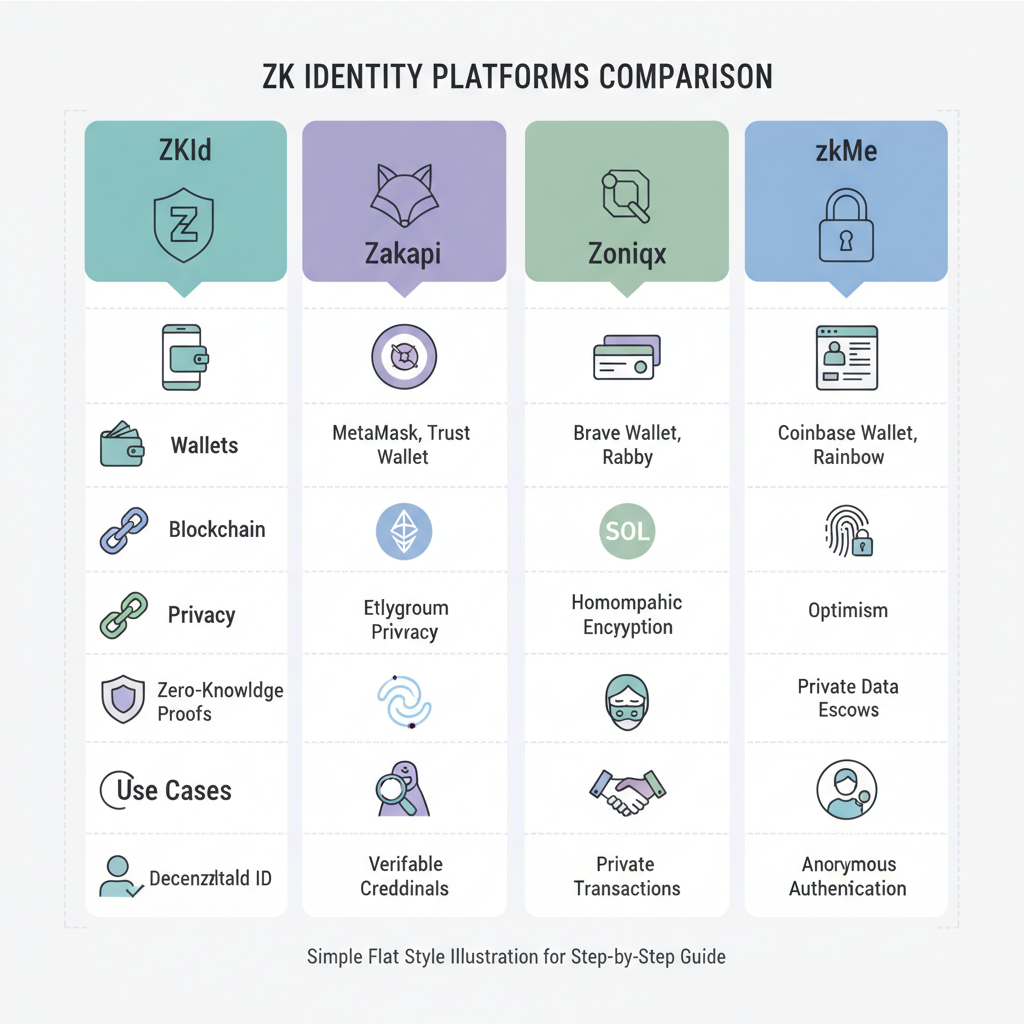

Spotlight on Pioneering zk Identity Wallet Platforms

Several innovators lead this charge. ZKId champions decentralized storage and ZKPs for sovereign control, ideal for individuals proving identity in cross-border finance. Zakapi targets enterprises with AML/CTF frameworks, offering jurisdictional compliance via zero-knowledge digital identity. Zoniqx’s zIdentity emphasizes cryptographic attestations, enabling institutions to verify claims while users manage data lifecycles.

zkMe’s zkKYC stands out for its private-by-design approach, eliminating centralized storage and repetitive KYC. These solutions tackle traditional pitfalls- data breaches, as seen in past financial scandals, and user friction. By 2026, adoption signals a pivot toward decentralized identity regulated DeFi, where SSI compliance proofs become standard.

Transitioning demands diligence: evaluate wallet security models, proof generation latency, and regulatory mappings. Early movers gain competitive edges, but laggards risk obsolescence in a privacy-first landscape.

Institutions eyeing zk identity wallets must weigh integration hurdles against profound risk reductions. While initial setups involve circuit optimization and verifier protocols, the payoff manifests in slashed compliance costs and fortified defenses against breaches that have plagued centralized KYC silos. In my experience navigating fixed income markets, where a single counterparty lapse cascades globally, these wallets represent a prudent hedge- one that prioritizes self-sovereign ID compliance proofs over outdated data dumps.

Risks and Mitigation Strategies for zk Identity Wallets

Adoption is not without pitfalls. Foremost, cryptographic vulnerabilities loom: zk-SNARKs rely on trusted setups, potentially exploitable if generators collude, while proof forgery risks persist absent rigorous verification. Interoperability gaps across blockchains fragment utility, and user errors in seed phrase management could unravel sovereignty. Regulators, per insights from SSRN’s ZKP compliance thesis, demand audit trails; incomplete ones invite fines under AML frameworks.

From a certified FRM standpoint, I advocate layered defenses. Mandate third-party audits for proof circuits, akin to smart contract reviews in DeFi. Employ hybrid models blending zk-STARKs for transparency with hardware security modules for key custody. Institutions should stress-test against correlation attacks, ensuring unlinkability as urged by Internet Policy Review analyses. Governance frameworks for credential issuers- banks or governments- prevent single points of issuer failure, much like diversified collateral in commodities trading.

Comparison of zkId, Zakapi, Zoniqx zIdentity, and zkMe zkKYC

| Solution | Key Features | Target Users | Key Compliance Strengths |

|---|---|---|---|

| zkId | Self-sovereign identity, zero-knowledge proofs (ZKPs), decentralized storage | Individuals | Prove identity without disclosing sensitive data; privacy-preserving verification (GDPR-aligned) |

| Zakapi | Zero-knowledge digital identity platform, comprehensive compliance frameworks | Governments and enterprises | Anti-Money Laundering (AML), Counter-Terrorist Financing (CTF), jurisdictional identity laws |

| Zoniqx zIdentity | Sovereign control over identity data, cryptographic attestations for verification | Individuals and institutions | Verify claims without data exposure; enhances digital trust in regulated environments |

| zkMe zkKYC | Decentralized, private-by-design KYC solution; verifiable credentials in personal wallet | Financial institutions and users | Eliminates centralized data storage; secure, compliant KYC without personal info exposure |

These measures transform risks into competitive moats. Platforms like Zoniqx already embed such resilience, signaling maturity in decentralized identity regulated DeFi.

Implementation Roadmap for Financial Institutions

Rollouts demand sequenced steps. Begin with pilot programs verifying accreditation for accredited investors, scaling to full AML/CTF suites. Leverage verifiable credentials from legacy KYC providers, transitioning users via peer DID exchanges. Monitor proof latency- critical for high-frequency trading- targeting sub-second generations via optimized rollups.

Success hinges on user education; frictionless onboarding curbs abandonment. Pair with analytics dashboards tracking proof efficacy, aligning with data minimization mandates from GDPR enforcers.

Advanced cryptographic techniques like self-sovereign identity and zero-knowledge proofs present promising approaches for anonymous authentication.

Pioneers such as zkMe demonstrate viability, with zkKYC slashing verification times by 80% in trials, per their Medium insights. This efficiency edges out rivals mired in paperwork quagmires.

The Horizon for Privacy-Preserving Identity Verification

By late 2026, zk identity wallets will underpin mainstream regulated finance, propelled by standards like those from Dock Labs and Mina Protocol. Expect EU MiCA regulations to endorse ZKPs explicitly, fostering cross-jurisdictional proofs for seamless DeFi access. Developer ecosystems will flourish, birthing composable credentials for dynamic compliance- prove “EU resident with clean AML record” across protocols without re-verification.

Challenges linger: scaling proofs amid Ethereum congestion or regulatory inertia in conservative markets. Yet, as Deutsche Bank explorations affirm, the ZKP-SSI nexus unlocks verifiable trust sans exposure. Financial entities ignoring this trajectory risk erosion in a landscape where privacy equates to premium.

Ultimately, these wallets cement user agency in identity stewardship, rendering repetitive disclosures relics. Finance’s future thrives on such innovations, where proof supplants presumption and sovereignty shields scrutiny.