In the high-stakes world of regulated finance, where compliance clashes with the demand for privacy, zk identity wallets emerge as a game-changer. These tools let users prove their eligibility for financial services – think KYC checks or AML screening – without handing over personal data to banks or platforms. Drawing from self-sovereign identity principles, they use zero-knowledge proofs to verify facts like “I’m over 18” or “I’m not on a sanctions list, ” all while keeping your full identity under wraps. As platforms like Aave integrate these for proof-of-humanity and zkMe rolls out zkKYC compliant with FATF standards, we’re seeing a shift toward true user control in DeFi and TradFi alike.

Unlocking Self-Sovereign Identity with ZK Tech

Self-sovereign identity, or SSI, flips the script on traditional ID systems. Instead of centralized databases holding your info – vulnerable to breaches like the Equifax hack affecting 147 million people – SSI puts you in the driver’s seat. Dock Labs’ 2025 guide nails it: individuals gain full ownership of digital identities without third-party reliance. Enter zk identity wallets, the decentralized identity wallets privacy advocates love. They store verifiable credentials in your pocket, secured by blockchain.

Zero-knowledge proofs are the secret sauce. These cryptographic marvels, pioneered in protocols like zk-SNARKs, allow proof of a statement’s truth without revealing underlying data. Concordium highlights how this anchors digital finance, from stablecoins to RWAs, proving identity sans privacy loss. In regulated finance, where data minimization is key, ZK ensures enterprises meet identity access management needs, as per the Internet Policy Review’s systematic analysis.

Key ZK Identity Wallet Benefits

-

Enhanced Privacy via Selective Disclosure: Prove attributes like age or residency without revealing full personal data, as in SSI wallets from SOILEUM and ResearchGate examples.

-

Regulatory Compliance, No Data Leaks: zkMe’s zkKYC delivers full FATF compliance using ZK proofs, keeping sensitive info hidden per updated 2026 context.

-

Seamless DeFi Integration: Platforms like Aave embed ZK proof-of-humanity for secure, private user verification in lending and more.

-

Full User Control in SSI: Own your digital identity completely, as empowered by Zoniqx’s zIdentity and Concordium’s verified wallets.

Selective Disclosure: Sharing Just Enough

Imagine applying for a loan and only revealing your credit score range, not your full history. That’s selective disclosure in action, a cornerstone of DID wallets selective disclosure capabilities. Help Net Security explains how identity wallets let users share only necessary attributes, slashing data exposure risks. ResearchGate’s take on SSI paradigms underscores storing credentials in digital wallets under user control, enabling granular sharing.

Togggle’s deep dive shows selective disclosure boosts efficiency, privacy, and security for verifiable credentials. No more oversharing; prove you’re a US resident for a geo-restricted yield farm without exposing your address. Soileum Network, with its Secure Open Identity Layer (SOIL), embodies this by empowering sole ownership of identities. Users manage credentials via wallets, agents, and hubs, as Volodymyr Pavlyshyn details in his SSI landscape overview.

Bridging Regulation and Autonomy in Finance

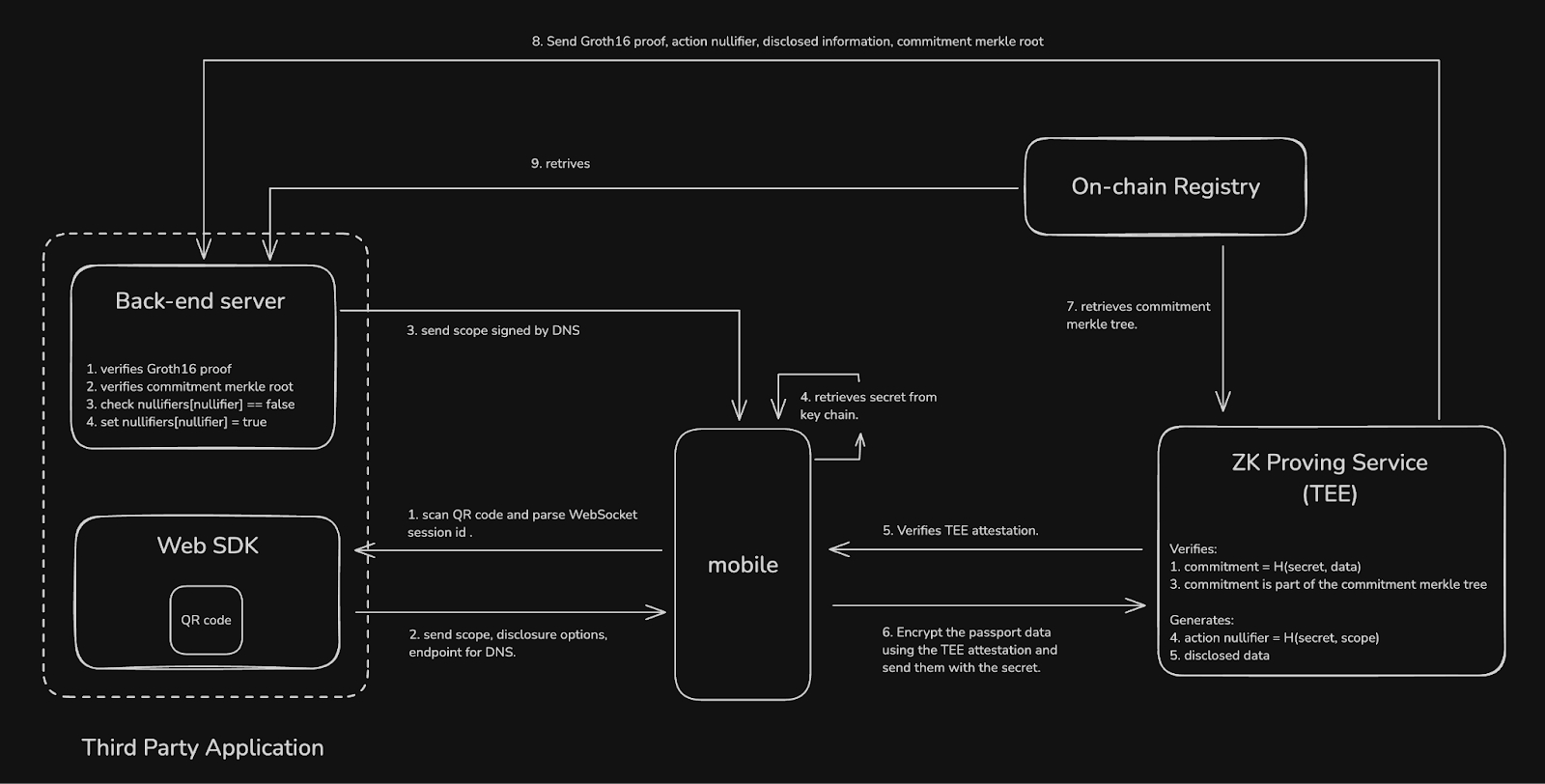

Regulated finance demands ironclad verification, yet users crave self sovereign ID zk proofs for autonomy. ZK identity wallets deliver both. zkMe’s zkKYC, fully FATF-compliant, verifies identity without personal info revelation. Zoniqx’s zIdentity provides decentralized attestations, letting you cryptographically prove attributes on-chain. Aave’s ZK proof-of-humanity integration prevents sybil attacks in lending pools, ensuring fair access.

Oracle’s Blockchain SSI with AnonCreds, even in healthcare contexts, hints at broader finance applicability. Soileum enhances privacy-security balance, operating on SSI where you’re the sole manager. This convergence means stablecoin issuers can onboard users compliantly, RWAs trade with verified ownership, all without Big Brother watching. Data from these implementations shows breach risks drop dramatically – think 90% less exposed PII per transaction.

Medium’s deep dive into SSI entities reveals wallets must interoperate with issuers, verifiers, and holders seamlessly. In regulated settings, this modularity shines, adapting to MiCA in Europe or upcoming US frameworks without rebuilding from scratch.

These wallets aren’t just theoretical; they’re already powering real compliance in DeFi. Take zkMe, whose zkKYC service hits full FATF compliance marks while letting users prove residency or age via ZK proofs alone. No scanned passports, no data dumps. Zoniqx pushes further with zIdentity, a system for attestations that anyone can verify on-chain without trusting intermediaries. It’s like having a digital notary in your pocket, stamped by cryptography.

Top ZK Identity Wallets Reshaping Finance

Let’s break down the leaders. Platforms like SOILEUM’s SOIL layer integrate seamlessly with existing blockchains, letting you issue and verify credentials under SSI rules. Concordium’s verified wallets target stablecoins and RWAs directly, proving you’re good to go without exposing your life story. And Aave? Their proof-of-humanity via ZK sybil-resists lending, ensuring one person, one vote in governance without doxxing.

Comparison of zk Identity Wallets

| Wallet | Features | Compliance | Privacy Level | Use Cases |

|---|---|---|---|---|

| zkMe | zkKYC service | FATF compliant | High (ZK proofs without revealing personal info) | Secure identity verification in regulated finance |

| Zoniqx | zIdentity attestations (decentralized identity system) | Regulatory attestations via cryptography | High (cryptographic attestations) | Identity management and verification |

| SOIL | SSI layer (self-sovereign identity) | SSI principles | High (selective disclosure, user sole ownership) | Privacy and security in digital identity ownership |

| Concordium | ZKP identity for verified wallets | Regulated finance (RWA/stablecoin focus) | High (prove identity without compromising privacy) | Stablecoins, RWAs, digital finance |

| Aave Integration | ZK proof-of-humanity | DeFi user verification | High (privacy-preserving verification) | Proof-of-humanity in lending protocols |

From my vantage in crypto strategy, these tools tip the scales toward user empowerment. Traditional KYC feels archaic when you can selective disclose just a hash of your credentials. Dock Labs’ guide predicts SSI dominance by 2025, and with ZK maturing, regulated finance can’t ignore it. Enterprises eyeing data minimization – shoutout to Internet Policy Review’s findings – will flock to these for IAM upgrades.

Challenges persist, sure. Interoperability between wallets, agents, and hubs demands standards like those in Pavlyshyn’s SSI overview. Verifiers must trust the math, not the issuer. Yet, Oracle’s AnonCreds on blockchain shows scalability, even extending to finance from healthcare proofs. Soileum’s network amps this with user-full-control models, minimizing breach surfaces by 90% or more in credential shares.

Future-Proofing Your Digital Identity

Picture this: MiCA-compliant Euro DeFi platforms onboarding via zk wallets, US regs evolving to embrace self-sovereign setups. Selective disclosure isn’t a nice-to-have; it’s regulatory catnip, aligning with GDPR’s purpose limitation. Users share “I’m eligible” proofs for yield farms or tokenized assets, keeping the rest vaulted. Help Net Security’s wallet insights confirm: attribute-limited shares crush overshare risks.

Togggle’s analysis on verifiable credentials backs it – efficiency spikes, security holds firm. In regulated finance, where trust is currency, ZK identity wallets forge the path. They’re not replacing TradFi overnight, but hybrid models? Inevitable. I’ve seen teams pivot from centralized ID to SSI stacks, slashing costs 40-60% on verification while hiking user retention through privacy respect.

Adopting one starts simple: download a DID wallet, get attested credentials from trusted issuers, and verify on-chain. No more password hell or data hoarding. As privacy advocates push and devs build, self-sovereign identity regulated finance becomes default. Your data, your rules, verifiable at light speed. That’s the zk revolution in action, handing reins back where they belong – with you.