In 2026, self-sovereign identity has transitioned from niche blockchain experiment to mainstream necessity, driven by zk identity wallets that harness zero-knowledge proofs for unparalleled privacy. These decentralized identity wallets 2026 let users prove attributes like age or nationality without exposing underlying data, reshaping how we interact with services from finance to government portals. As privacy regulations tighten under frameworks like the EU’s eIDAS 2.0, which mandates privacy-enhancing tech such as ZKPs, adoption surges among enterprises and individuals alike.

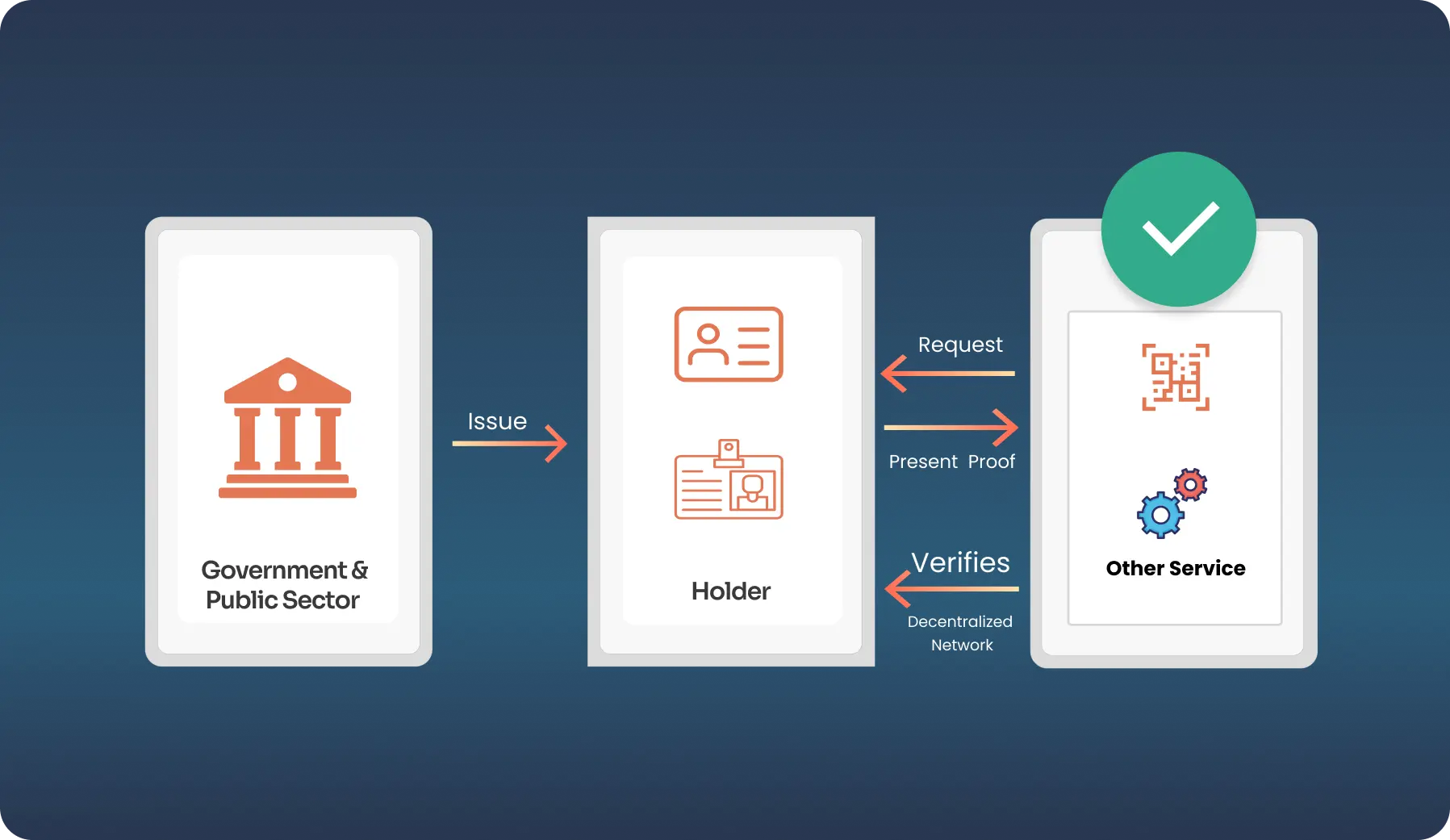

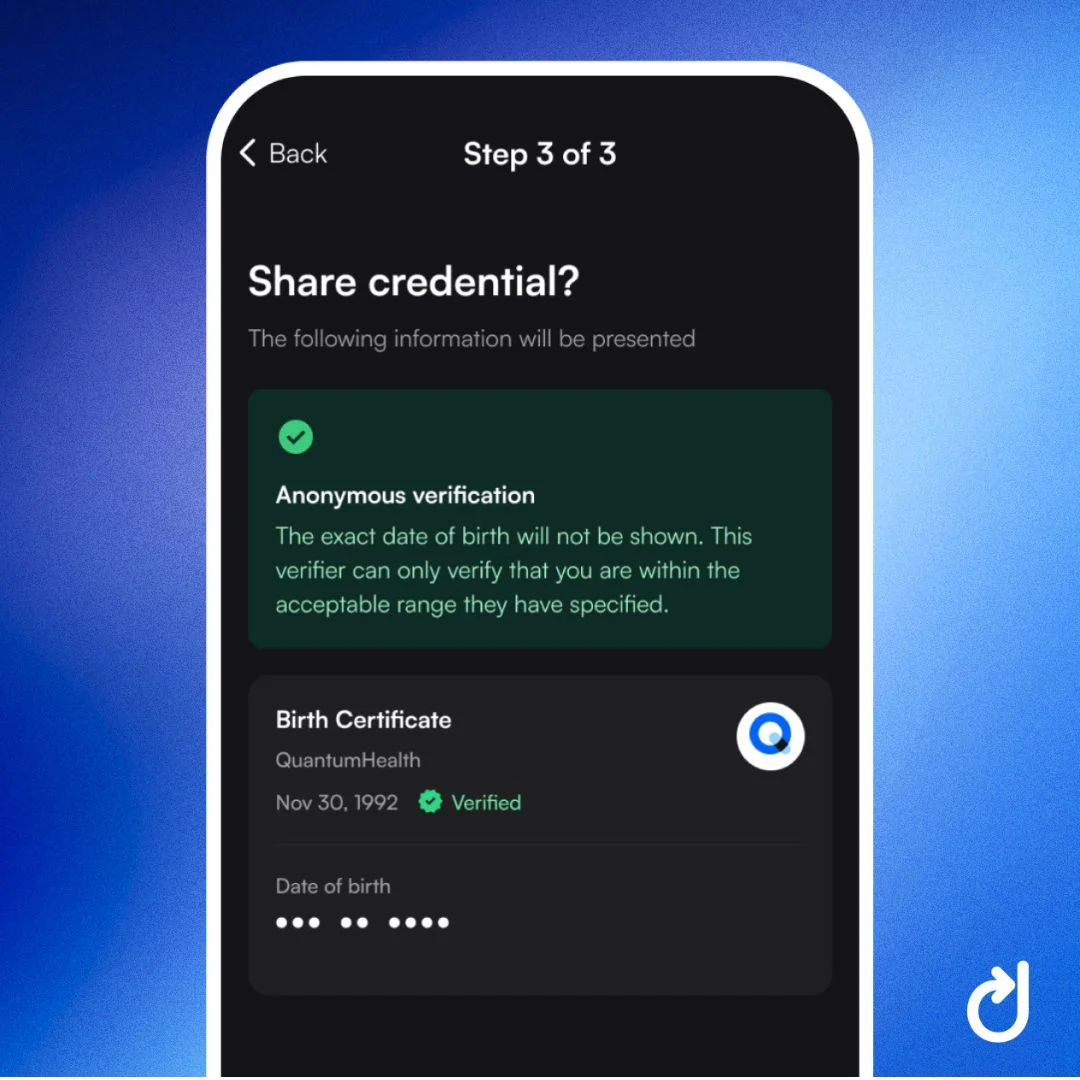

This evolution addresses long-standing vulnerabilities in centralized identity systems, where data breaches routinely compromise millions. With self-sovereign identity zk proofs, control reverts to the user: decentralized identifiers (DIDs) anchor credentials on blockchains, while ZKPs enable selective disclosure. No longer must you hand over your full passport for a simple verification; instead, cryptographic magic confirms just enough.

Dissecting Zero-Knowledge Proofs in DID Wallets

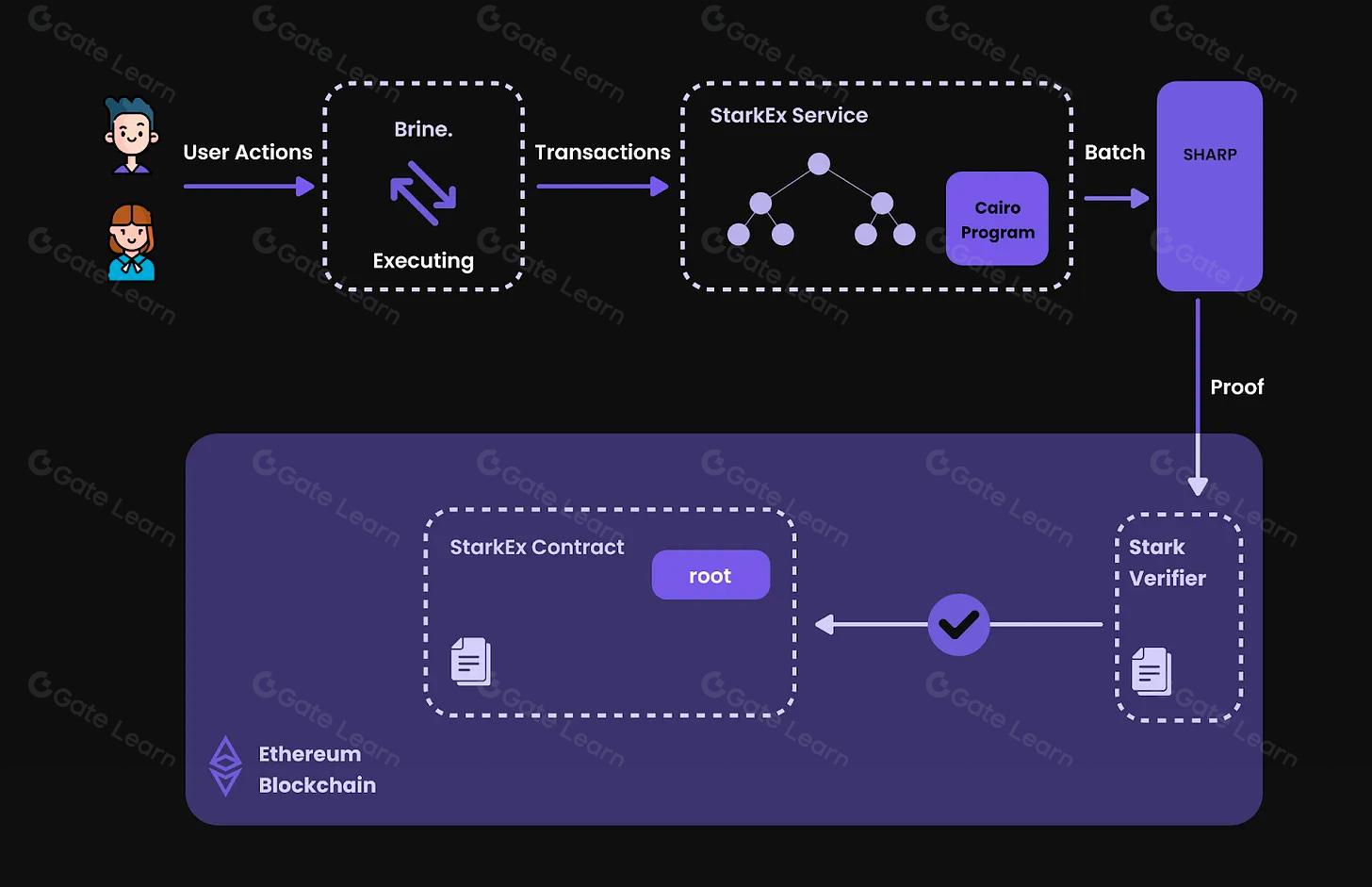

Zero-knowledge proofs (ZKPs) operate on a deceptively simple premise: prove a statement’s truth without revealing supporting evidence. In zero knowledge DID wallets, this manifests through protocols like zk-SNARKs or zk-STARKs, which generate compact proofs verifiable in milliseconds. Consider a job application: your wallet issues a credential proving “over 5 years experience” via ZKP, derived from a verifiable credential (VC) issued by a past employer, all without disclosing your resume.

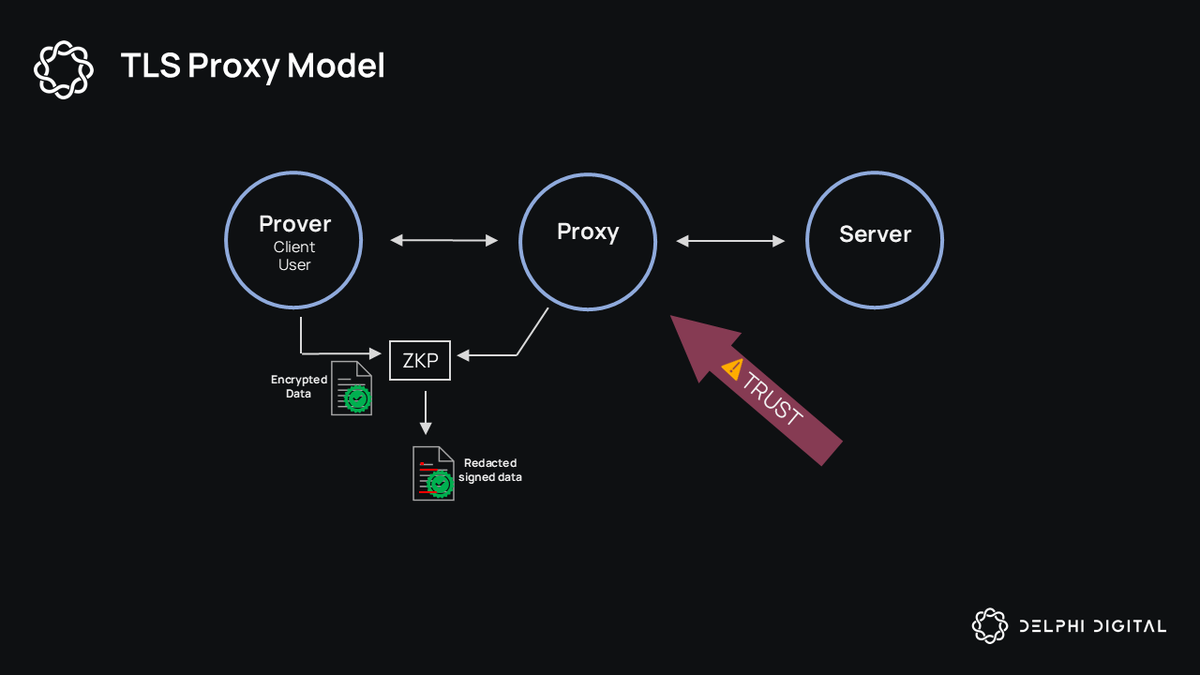

From a risk-management standpoint, honed over 14 years in global markets, this is transformative. Traditional identity systems create single points of failure; SSI zk wallets distribute risk via cryptography. Projects integrate zkTLS, bridging web2 data to web3 proofs without server trust, as seen in OnChain Passport’s showcases where data remains user-side.

Core Advantages of SSI ZK Wallets

-

Selective Disclosure: Prove claims like age or nationality without revealing full data, using ZKPs as in ZKId and zkMe on Polygon ID.

-

Blockchain-Anchored DIDs: Tamper-proof history via immutable ledger anchoring, enabling verifiable credentials in Oracle’s SSI and Concordium wallets.

-

zkTLS: Seamless Web2-to-Web3 transitions by proving TLS session data privately, bridging credentials without exposure.

-

eIDAS 2.0 Compliance: Meets EU privacy mandates with ZKP-enhanced wallets for EUDI credentials and regulatory standards.

-

Reduced Breach Risks: No central honeypots as data stays user-side, minimizing impacts unlike traditional IAM systems.

2026 Landscape: Platforms Pioneering zk Integration

February 2026 marks a pivotal moment, with platforms like ZKId leading the charge. ZKId empowers users to craft DIDs and VCs stored decentralally, leveraging ZKPs for proofs that preserve anonymity. Its toolkit suits developers building privacy-first apps, aligning with my pragmatic view that true innovation scales through accessible tools.

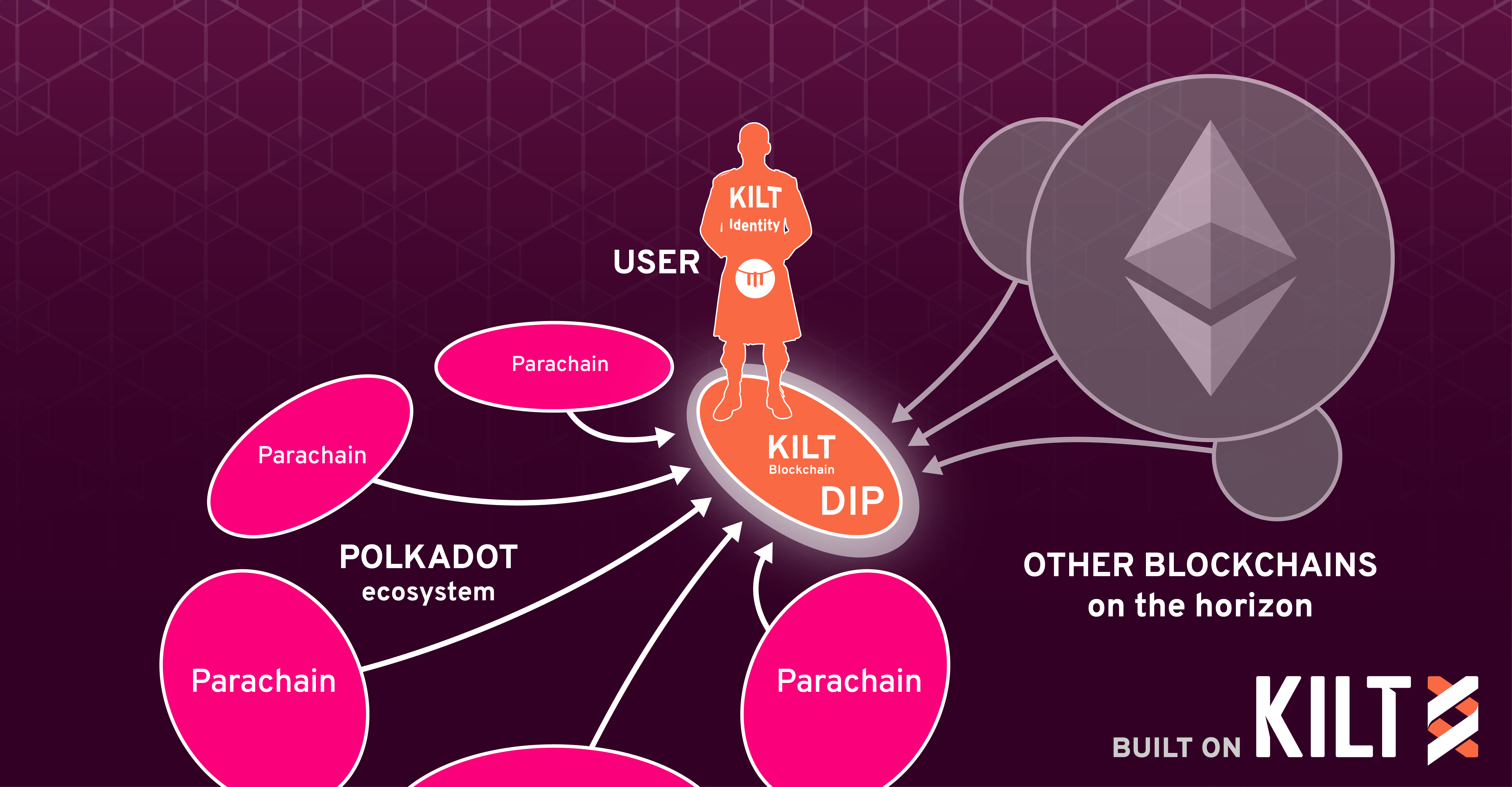

Meanwhile, zkMe on Polygon ID delivers the first decentralized issuer in this ecosystem, allowing B2B verification sans personal data leaks. Oracle’s blockchain SSI solution complements this, binding credentials cryptographically to holders and shunning correlatable IDs. These aren’t hypotheticals; they’re live, handling real-world flows like KYC in DeFi or EUDI wallet compliance. Concordium’s dApps further exemplify wallet-generated proofs for attributes like nationality, proving SSI’s maturity.

Privacy Imperatives Driving SSI zk Wallets Adoption

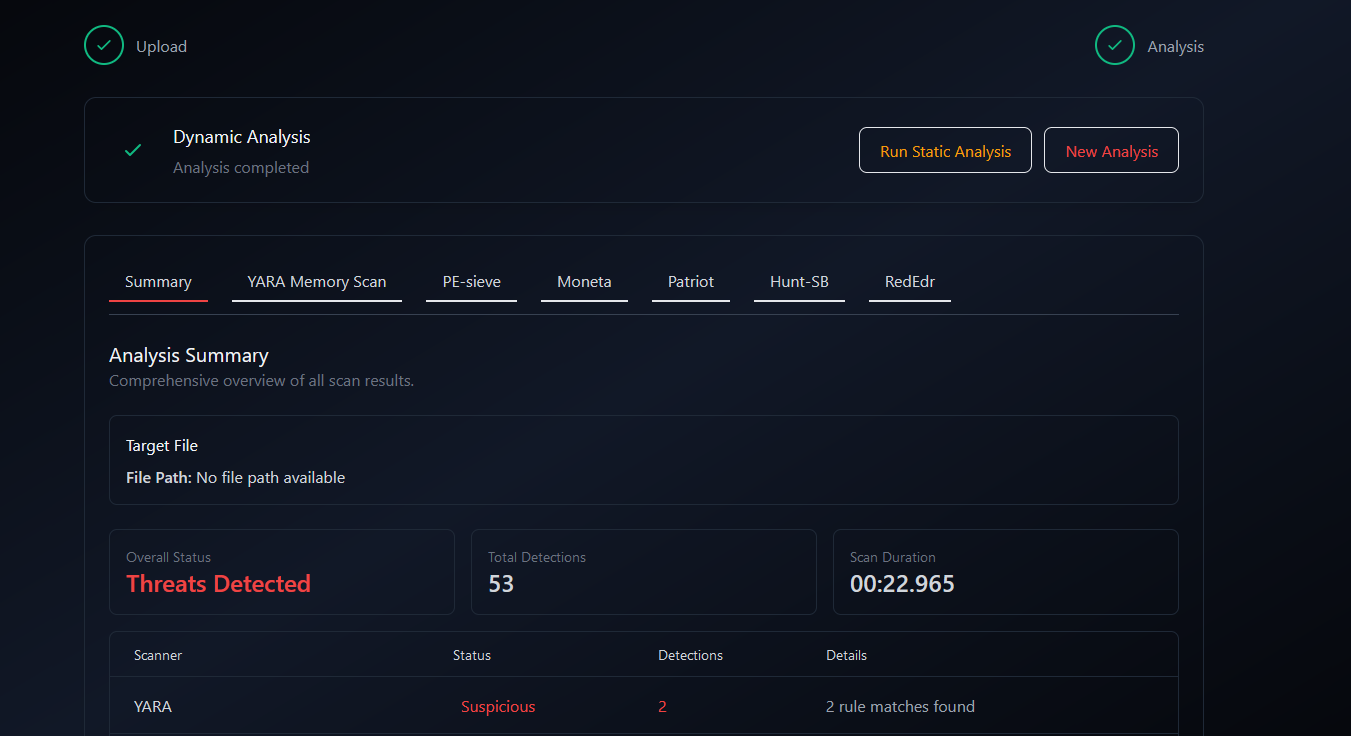

Events of 2026, including high-profile verifiable credential spoofing incidents, underscore ZKPs’ urgency. Medium reports highlight DID tech’s leap, yet warn of ongoing battles for digital sovereignty. Enterprises, per Internet Policy Review analyses, demand data minimization; SSI delivers via ZKPs, meeting identity management needs without over-sharing.

Dock Labs’ primer nails it: ZKPs verify without revelation, ideal for SSI zk wallets privacy. ResearchGate notes SSI’s role in wallet ecosystems fueling electronic markets, though nascent challenges persist. Google’s push for open ZKP tech dovetails with eIDAS, urging Member States toward integration. In my assessment, this convergence minimizes systemic risks, much like diversified portfolios weather volatility; users gain clarity and control over their digital assets.

Real-world applications reveal the pragmatic edge of these tools. In DeFi, zk identity wallets streamline KYC by proving residency without passports, slashing onboarding friction while complying with AML regs. Governments leverage them for EUDI wallets, where citizens flash proofs of eligibility for benefits, echoing arXiv’s vision of SSI from distributed ledgers granting full control. Enterprises, facing data minimization mandates, deploy zkMe for B2B verifications, as Polygon ID integration proves credentials tamper-proof and private.

Leading Platforms: A Side-by-Side Analysis

To gauge maturity, consider the 2026 frontrunners. ZKId stands out for developer-friendly DID/VC issuance with decentralized storage, ideal for custom apps. zkMe’s Polygon ID debut targets B2B, emphasizing zero-knowledge cryptography for credential issuance sans exposure. Oracle’s blockchain play prioritizes enterprise-scale binding of proofs to holders, dodging correlatable IDs. Concordium adds dApp flexibility, letting wallets prove attributes like age on-chain.

Comparison of zk Identity Wallets (2026)

| Project | Key Features | Supported Chains | Maturity Level |

|---|---|---|---|

| ZKId | DID/VC issuance, ZKPs, decentralized storage | Multi | Developer-focused |

| zkMe / Polygon ID | Decentralized issuer, B2B privacy via ZK cryptography | Polygon | Production B2B |

| Oracle SSI | VC with ZKPs, no correlatable IDs, selective disclosure | Oracle Blockchain | Enterprise |

| Concordium | Wallet-generated ZK proofs for attributes (e.g., age, nationality) | Concordium | dApp-ready |

This comparison underscores a ecosystem diversifying across chains and use cases, yet unified by ZKP cores. From a portfolio lens, diversify your identity stack similarly: mix generalist tools like ZKId with specialized ones like zkMe to hedge against protocol risks.

Essential Steps to Deploy ZK Identity Wallet

-

1. Select platform: Choose ZKId (zkid.digital) for developers or zkMe on Polygon ID (blog.zk.me) for B2B.

-

2. Generate DID: Create a Decentralized Identifier (DID) and anchor it on blockchain (e.g., Polygon or Concordium) for tamper-proof verification.

-

3. Collect/issue VCs: Gather or issue Verifiable Credentials from trusted issuers, leveraging ZKPs for selective disclosure and privacy.

-

4. Practice zkTLS: Use zkTLS to import Web2 data (e.g., from sites) into wallet without exposing full credentials.

-

5. Test in sandboxes: Validate ZK proofs in platform sandboxes (e.g., Polygon ID, ZKId) before live deployment.

-

6. Monitor eIDAS: Track 2026 eIDAS regulation updates, integrating ZKP for EU-compliant privacy-enhancing identity.

Navigating Risks in SSI zk Wallets

Despite promise, hurdles remain. Verifiable credential spoofing, as Medium’s InstaTunnel piece details from 2026 incidents, tests DID resilience; ZKPs counter by cryptographic rigor, but user error in VC issuance lingers. Scalability bites too: zk-SNARKs prove fast, yet setup demands compute. My take, drawn from digital asset volatility? Prioritize audited proofs and hybrid chains; SSI isn’t zero-risk, but far superior to centralized vaults harvesting data.

Regulatory tailwinds accelerate fixes. eIDAS 2.0, effective now, compels ZKP integration, per Google’s advocacy. ResearchGate flags SSI’s youth in wallet ecosystems, yet electronic market growth hinges on it. Internet Policy Review affirms ZKPs’ fit for enterprise IAM, minimizing data while maximizing utility.

Forward-looking, expect zk identity wallets to embed in everyday apps, from social logins to cross-border finance. Platforms evolve: zkTLS matures for seamless web2 bridges, selective disclosure norms shift user expectations. Investors and advocates alike should experiment now; control your digital self before mandates force it. This tech, blending crypto precision with user agency, delivers the clarity I’ve long championed in markets: informed choices yield enduring gains.