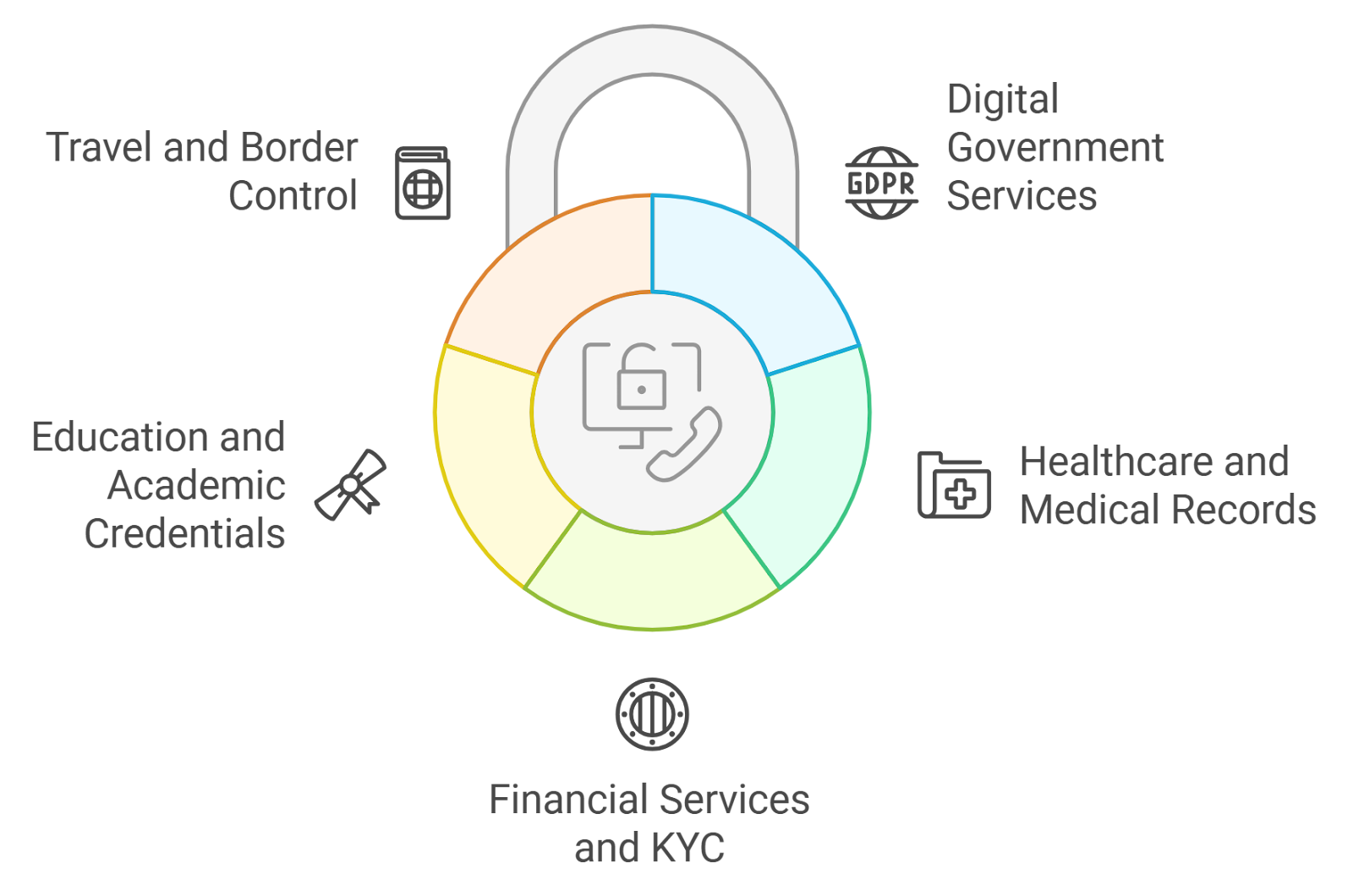

In regulated finance, where compliance clashes with privacy, ZK identity wallets emerge as the pivotal tool for self-sovereign identity. These decentralized identity wallets leverage zero-knowledge proofs to let users prove eligibility – like age over 18 or residency in a jurisdiction – without exposing underlying data. No more handing passports to banks; instead, cryptographic magic verifies claims selectively, slashing breach risks and data silos.

This shift matters because traditional KYC processes hoard sensitive info in vulnerable central databases, fueling mega-breaches and regulatory headaches. With decentralized identity wallet zk proofs, finance flips the script: users retain control, institutions gain trustless verification, and regulators get auditable proofs minus the personal details.

Zero-Knowledge Proofs: The Cryptographic Backbone

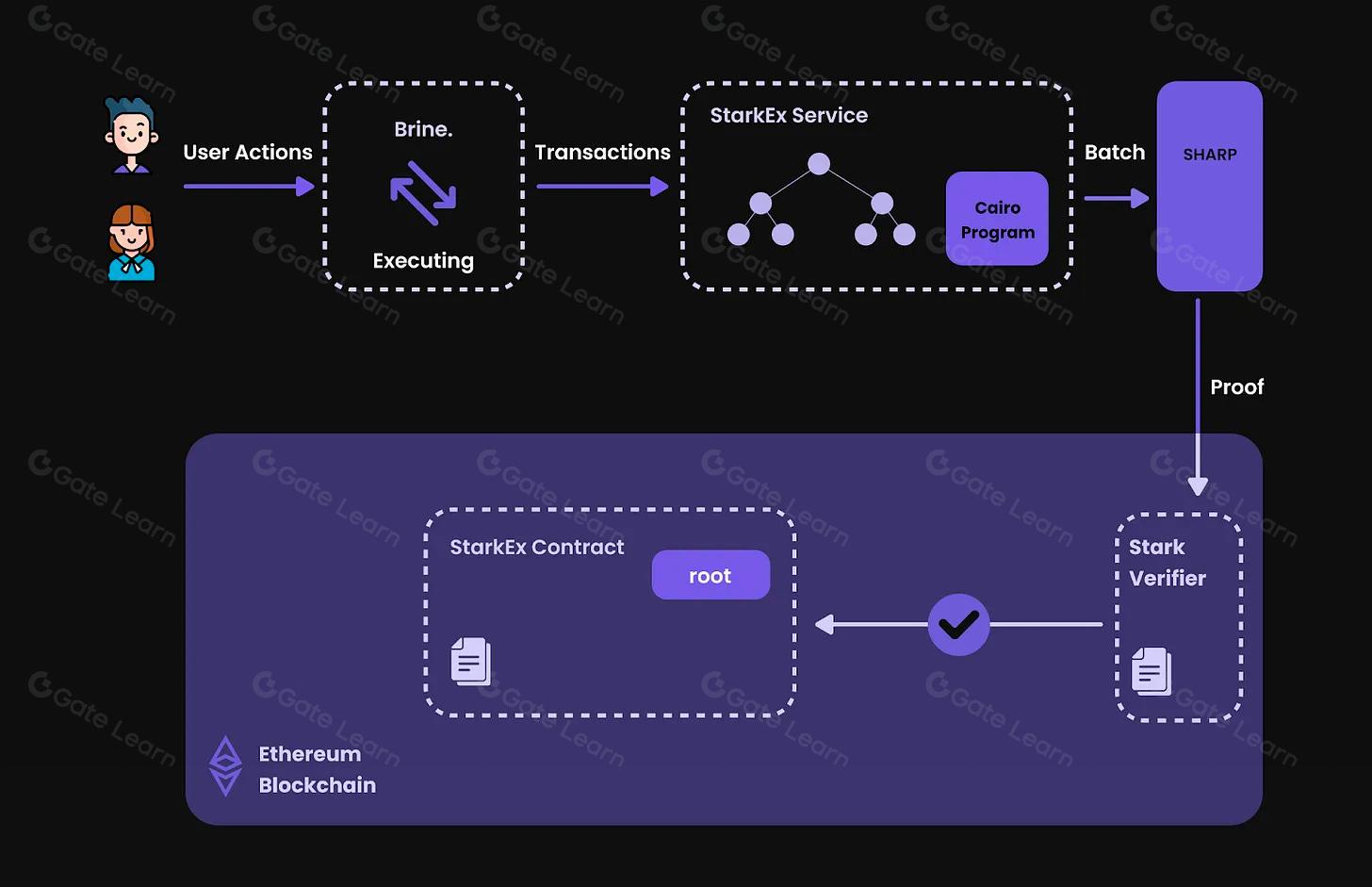

At the core of zero knowledge identity verification lies ZKPs, protocols where provers convince verifiers of a statement’s truth without revealing extras. Think zk-SNARKs or zk-STARKs: compact, efficient math enabling did wallet privacy finance. In SSI, this powers selective disclosure – prove you’re a U. S. resident for FATF compliance without sharing your address.

Recent research underscores the edge. Studies from arXiv and ScienceDirect highlight how SSI with ZKPs meets enterprise identity needs, minimizing data while satisfying audits. It’s not theoretical; it’s deployable now in DeFi and TradFi hybrids.

Trailblazing Projects Reshaping Regulated Finance

zkMe leads with zkKYC, a decentralized KYC marrying ZKPs to FATF standards. Users generate reusable credentials for personalhood or citizenship proofs, processed locally or via oracles – no central storage. This obliterates repeat verifications, cutting costs 80% per some estimates.

Privado ID, evolved from Polygon ID, goes protocol-agnostic, proving attributes like age sans full disclosure. Ideal for DeFi lending or TradFi onboarding, it bridges chains effortlessly.

Zoniqx’s zIdentity layers attestation, storage, and verification with BLS signatures and threshold schemes, scaling privacy for mass adoption. Oracle piles on with blockchain SSI using AnonCreds and ZKPs, dodging correlatable IDs for true anonymity.

Core Advantages of ZK Identity Wallets

-

User data sovereignty: Control personal identity data securely in your digital wallet, as in zkMe’s zkKYC and Privado ID.

-

Regulatory compliance via selective proofs: Verify attributes like age or citizenship with ZKPs without full disclosure, meeting FATF standards (zkMe zkKYC).

-

Reduced breach surfaces: No centralized storage; data processed locally on user devices or decentralized networks, minimizing hack risks.

-

Reusable credentials across platforms: Verifiable credentials work protocol-agnostically, as in Zoniqx zIdentity and Oracle SSI.

-

Cost savings on repeated KYC: Eliminate redundant verifications, transforming identity from cost center to efficiency driver.

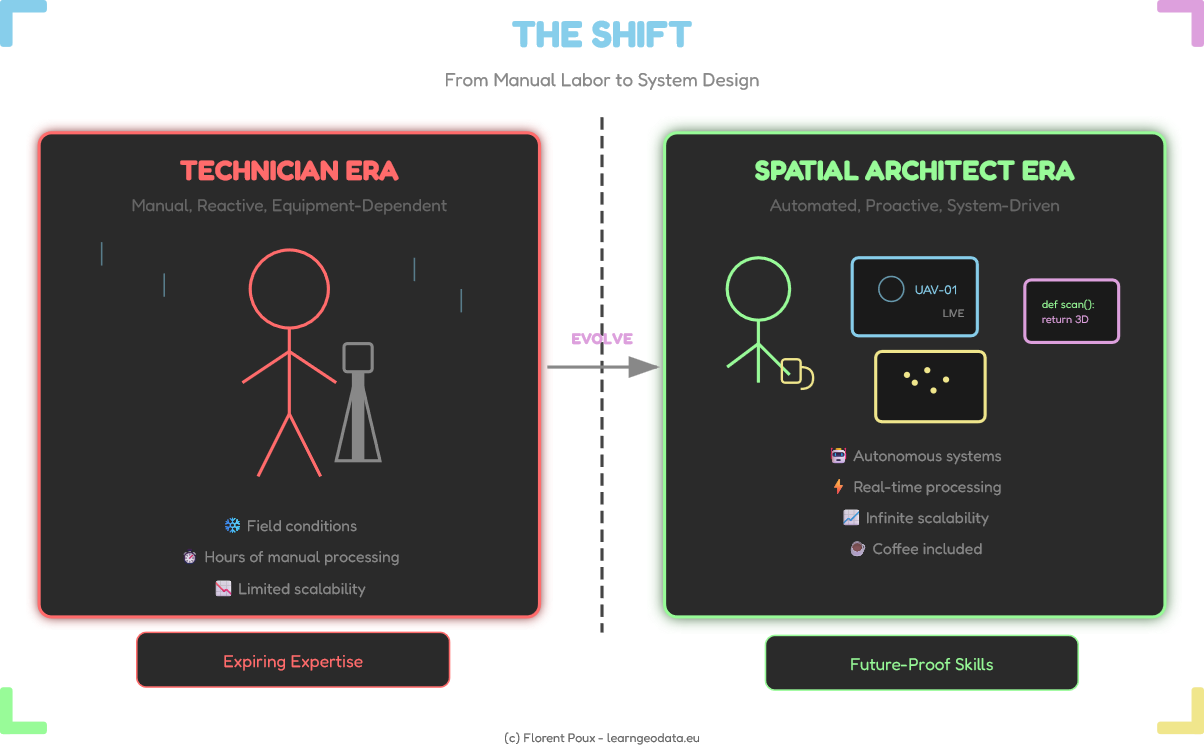

Why Institutions Are Betting Big on SSI

Banks and fintechs see self sovereign identity regulated finance as a moat. Mesh Digital nails it: identity shifts from drag to driver. Verifiable presentations let customers onboard faster, workers prove skills privately, all while ticking AML boxes.

Consider the privacy boost. Dock Labs and Cardano Foundation docs show selective disclosure curbs over-sharing, aligning with GDPR and beyond. In finance, where data is dynamite, this defuses risks without slowing deals.

Developers, take note: integrating zk identity wallet tools demands grasping credential formats. ECDSA falls short on selectivity per PET Symposium, but ZK variants shine. Early movers like these projects position finance for a privacy-first era, where control stays with individuals, not intermediaries.

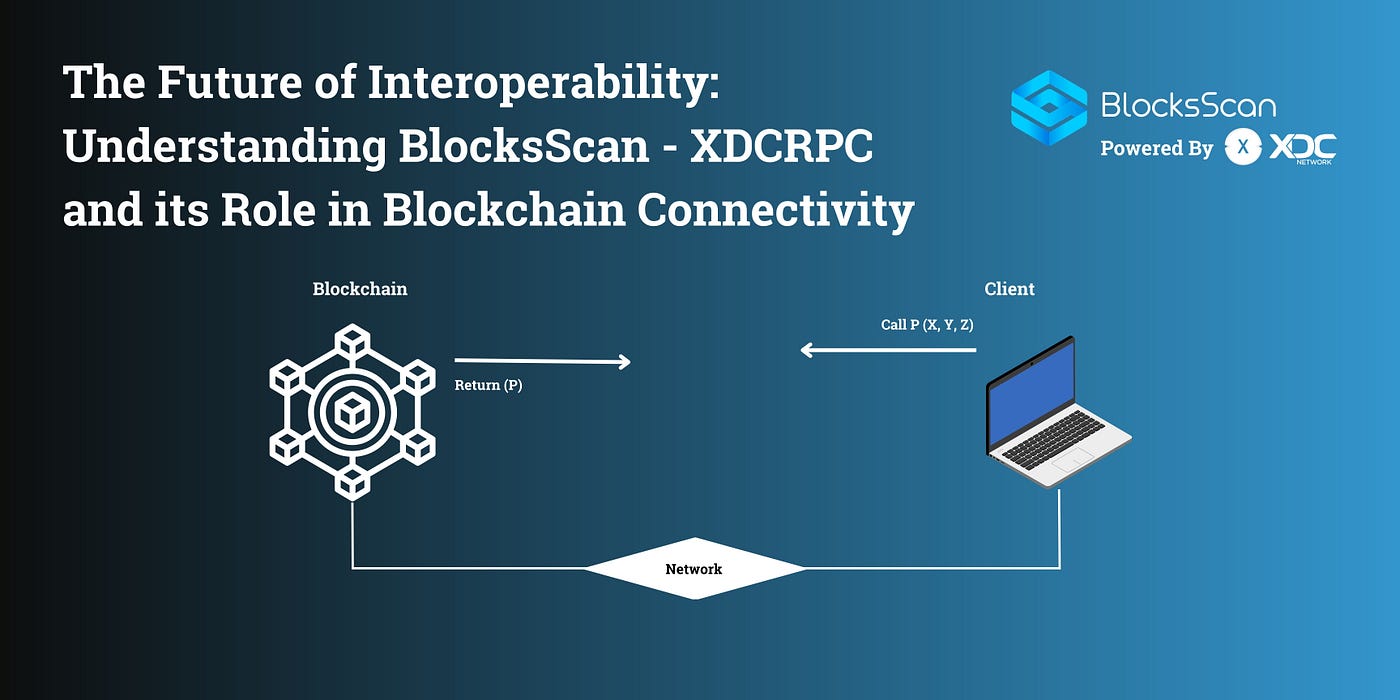

Interoperability remains the thorniest issue. Without unified standards, ZK wallets risk fragmentation – zk-SNARKs here, STARKs there, clashing DID methods everywhere. Yet projects like Zoniqx push layered architectures that abstract this away, making cross-chain proofs seamless. Finance pros: prioritize wallets supporting W3C Verifiable Credentials; they’re the glue holding SSI together.

Regulatory fog adds friction. FATF loves compliance proofs but squints at decentralization. zkMe’s zkKYC smartly threads the needle, generating auditable ZKPs that regulators can inspect sans raw data. Opinion: skeptics calling this vaporware miss the point. Oracle’s enterprise-grade SSI proves TradFi incumbents are already wiring it in, turning compliance from chore to competitive edge.

Navigating Challenges: Real-World Hurdles and Fixes

User onboarding trips many up. Non-crypto natives balk at key management, but zk identity wallets simplify with biometric guards and recovery shares. Substack’s Digital Bytes nails the tension: SSI promises sovereignty yet demands tech savvy. Solution? Hybrid apps blending ZK with familiar UIs, like Privado ID’s age proofs for instant DeFi access.

Scalability bites too. ZK proofs chew compute, but optimizations in zkMe’s oracle networks and Zoniqx’s threshold schemes slash latency. For decentralized identity wallet zk proofs, benchmark against Polygon-era tools; newer iterations clock under seconds per verification.

Key Hurdles in ZK Wallet Adoption

-

Interoperability Gaps: Varying protocols across zkMe, Privado ID (ex-Polygon ID), and Zoniqx hinder seamless credential sharing in multi-chain finance.

-

User Education Barriers: Complex ZKPs and selective disclosure overwhelm users, as noted in Dock Labs and Cardano Foundation guides on SSI.

-

Compute Overhead: ZKP generation in wallets like zkMe’s zkKYC demands high device resources, limiting mobile financial use.

-

Evolving Regulations: FATF compliance shifts challenge zkKYC and SSI, per zkMe and Internet Policy Review analyses.

-

Legacy System Integration: Bridging ZK wallets with traditional finance requires hybrid solutions, as Oracle’s blockchain SSI highlights.

Institutions face legacy drag. Migrating from Oracle databases to blockchain SSI? Start small: pilot zkKYC for high-risk clients. Mesh Digital’s thesis rings true – this moat favors agile fintechs over lumbering banks.

Getting Started: Practical Roadmap

Dive in with action. Users: grab zkMe or Privado ID apps, scan official docs for wallet setup. Generate a DID, fetch credentials from trusted issuers, then prove attributes on-chain. Developers: fork Zoniqx repos for BLS aggregation; integrate via SDKs for plug-and-play zero knowledge identity verification.

Finance teams: audit against arXiv’s SSI models. Test selective disclosure for AML – prove ‘over 18 and sanctioned-free’ without names. Link this to top privacy tools for vetted stacks. Early tests show 70% faster onboarding, per Engineered Science benchmarks.

Privacy advocates: layer with ephemeral keys for one-shot proofs, dodging linkage attacks. Cardano Foundation’s guide spotlights this: SSI thrives on minimal revelation.

The Horizon: Finance Reimagined

Picture 2030: seamless borderless banking where your zk identity wallet unlocks loans via citizenship proof alone. No forms, no fatigue. Internet Policy Review’s data minimization thesis scales here – ZKPs enforce it cryptographically.

Critics fret trust models; PET Symposium’s SoK flags issuer risks. Counter: decentralized attestors and revocation lists fix that. Zoniqx’s silent thresholds distribute liability, making collusion futile.

Stake your claim now. As regulated finance hurtles toward self sovereign identity regulated finance, wallets like these don’t just protect data – they empower it. Individuals wield credentials as assets, institutions verify at light speed, regulators audit shadows not souls. The old guard hoards; the new liberates. Choose sovereignty.