Self-sovereign identity (SSI) wallets are fundamentally reshaping how individuals and organizations manage digital identity. By shifting control from centralized authorities to users themselves, SSI wallets directly address modern concerns around privacy, data security, and efficiency. In a world where digital footprints are constantly expanding, these wallets offer a disciplined approach to identity management that is both robust and user-centric.

Enhanced Privacy and Data Control

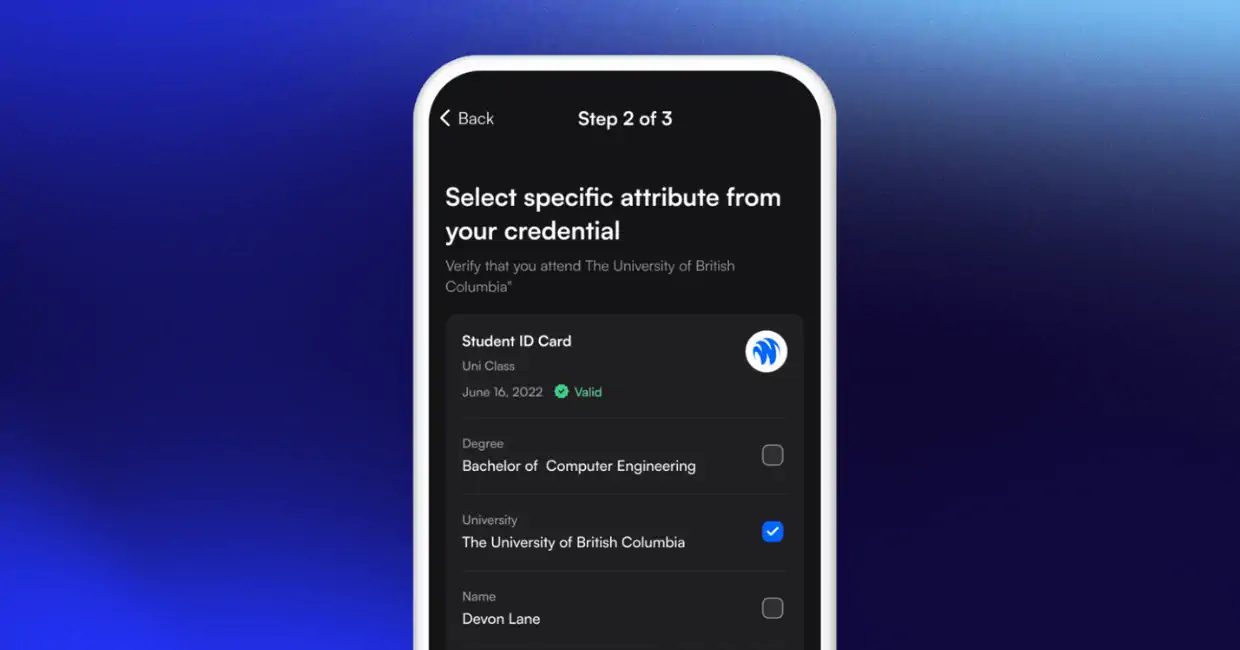

One of the most transformative self-sovereign identity wallet benefits is the ability to selectively share only what’s necessary. Using zero-knowledge proofs (ZKPs), SSI wallets empower users to confirm facts, such as being over 18 or holding a valid license, without exposing underlying personal data. This cryptographic innovation minimizes exposure to surveillance and drastically reduces the risk of mass data breaches that plague centralized systems. As highlighted by TrustCloud, this selective disclosure is not just theoretical; it’s already being implemented in financial services, healthcare, and beyond.

“SSI wallets put privacy back in the hands of users by letting them decide exactly which pieces of information to share, and with whom. “

Seamless Cross-Platform Authentication

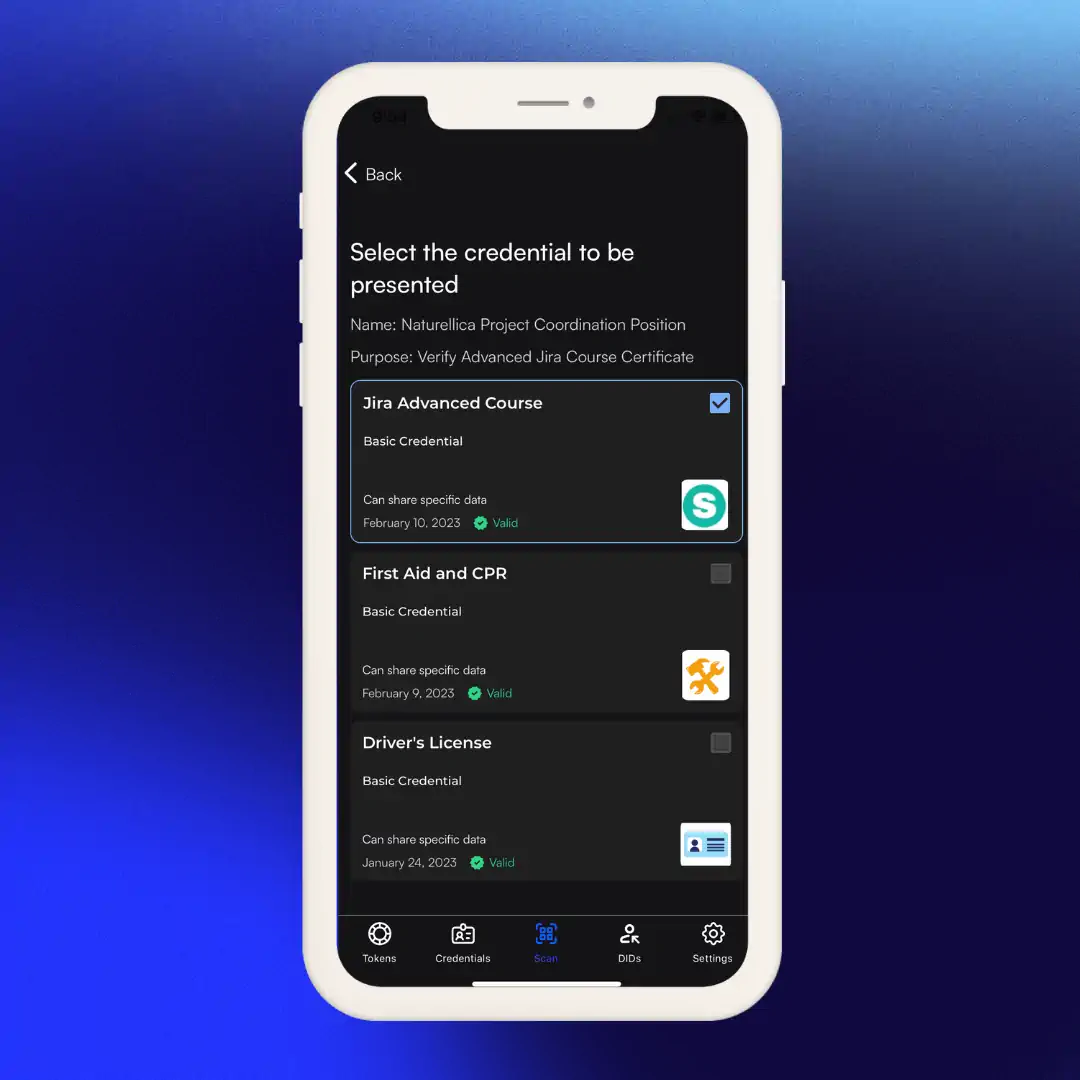

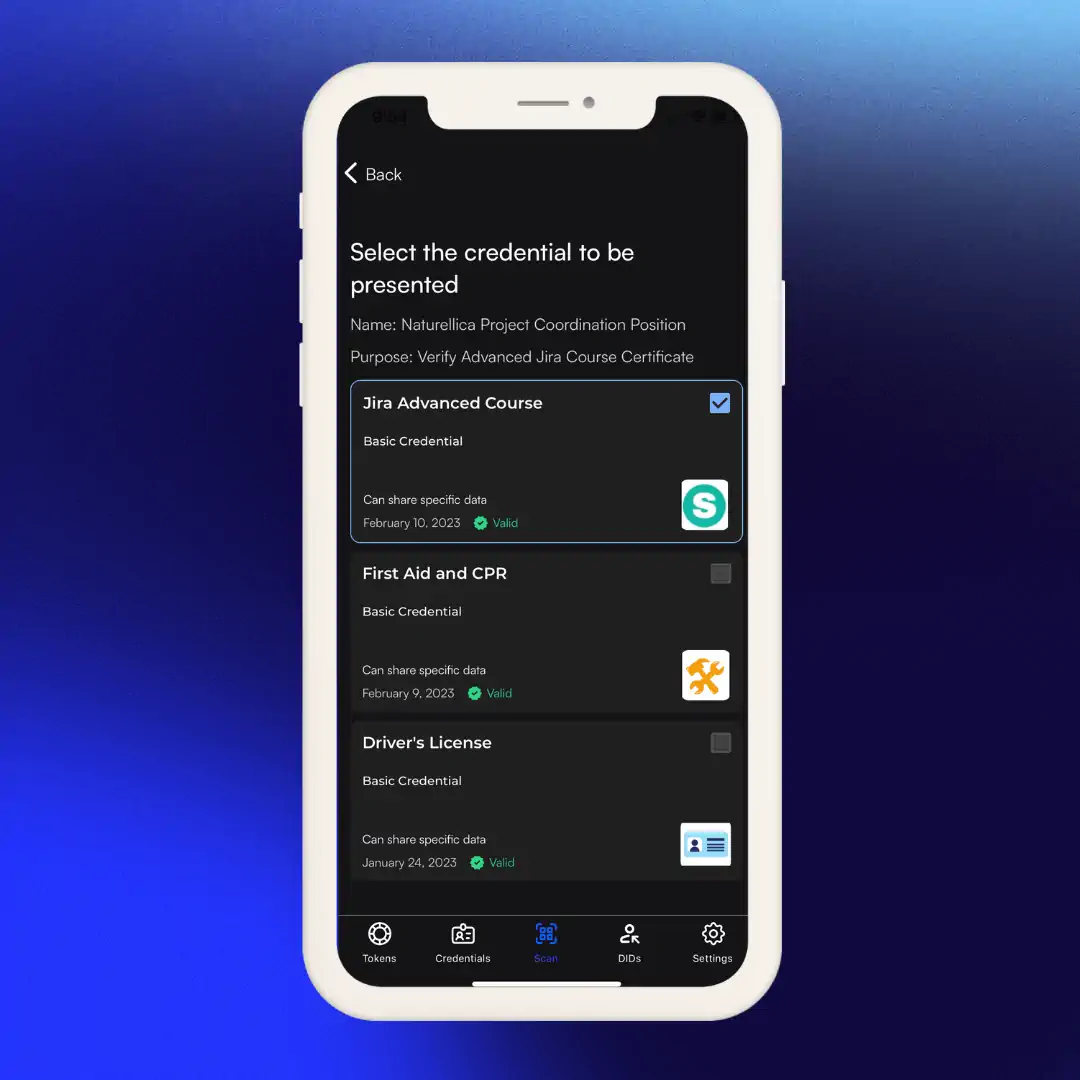

The modern digital landscape requires frequent authentication across banking apps, healthcare portals, e-commerce platforms, and government services. Traditionally, this means repeatedly submitting personal documents or creating new accounts for every service, a process prone to friction and security lapses. SSI wallets solve this by providing portable digital identity credentials that are interoperable across platforms. With a single set of verifiable credentials stored securely on their device, users can authenticate quickly wherever they go. This approach not only boosts convenience but also drastically reduces redundant data sharing.

Fraud-Proof Credential Verification

The proliferation of fake diplomas, forged certifications, and counterfeit credentials has long undermined trust in digital ecosystems. SSI wallets address this challenge head-on through cryptographically secured credentials that are tamper-resistant and instantly verifiable. Educational institutions can issue digital diplomas directly into graduates’ wallets; employers can verify these with a single click, no more chasing down paperwork or waiting weeks for verification. This capability extends far beyond academia: professional licenses, compliance certificates, and even tickets for events can all be issued as fraud-proof verifiable credentials.

5 Real-World Benefits of Self-Sovereign Identity Wallets

-

Enhanced Privacy and Data Control: SSI wallets empower users to selectively share only necessary identity attributes using zero-knowledge proofs (ZKPs). This approach minimizes data exposure, reduces the risk of surveillance, and protects against mass data breaches by never revealing more information than required.

-

Seamless Cross-Platform Authentication: With interoperable and portable credentials, users can access multiple digital services—such as banking, healthcare, and government portals—without repeatedly submitting personal information. This streamlines digital interactions and enhances user experience across platforms.

-

Fraud-Proof Credential Verification: SSI wallets enable organizations and individuals to issue and verify tamper-resistant digital credentials (e.g., diplomas, professional certifications) that are cryptographically secured, significantly reducing the risk of forgery and credential fraud.

-

Elimination of Third-Party Dependency: By removing the need for centralized identity providers, SSI wallets give users direct ownership and management of their digital identities. This decentralization enhances security and user autonomy across online platforms.

-

Streamlined Onboarding and Compliance: Businesses can leverage SSI wallets to verify reusable, verifiable credentials for faster Know Your Customer (KYC) and Anti-Money Laundering (AML) onboarding. This reduces operational costs, friction, and time while maintaining regulatory compliance.

Elimination of Third-Party Dependency

The traditional model of digital identity relies heavily on centralized providers, think social networks or government agencies, to vouch for user identities. This creates single points of failure and introduces risks around censorship, lockout, or misuse of personal data. With SSI wallets, users gain direct ownership over their identities. There’s no need to trust third parties with sensitive information or depend on them for access to services. Instead, individuals manage their own credentials securely on their devices, and can grant or revoke access as they see fit.

This paradigm shift not only improves personal autonomy but also fosters greater resilience across the entire digital ecosystem, a crucial step toward building a more trustworthy internet infrastructure.

Direct ownership of digital identity is more than a technical upgrade, it is a fundamental shift in power. By eliminating third-party dependency, SSI wallets reduce the potential for data monopolies and the abuse of user information. This approach aligns closely with emerging regulatory trends that emphasize user consent and data minimization, as discussed by experts at TrustCloud. The result is a more equitable digital environment where users are no longer at the mercy of opaque algorithms or arbitrary account suspensions.

Streamlined Onboarding and Compliance

For businesses, onboarding new customers or partners often involves cumbersome Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures. SSI wallets introduce a disciplined solution: reusable, verifiable credentials that can be instantly validated. This means organizations can fulfill regulatory requirements without repeatedly collecting sensitive documents or risking data redundancy. The efficiency gains are significant, reduced operational costs, faster customer acquisition, and improved compliance outcomes.

From a user perspective, this translates to less friction when accessing financial services, enrolling in educational programs, or verifying eligibility for government benefits. Instead of filling out forms and uploading documents for every new service, individuals present pre-verified credentials from their SSI wallet, speeding up processes while maintaining strict privacy controls.

Real-World Impact Across Sectors

The transformative potential of SSI wallets extends across industries:

- Healthcare: Patients control their medical records, sharing only relevant details with providers as needed.

- Education: Graduates instantly share verified diplomas with employers worldwide.

- Finance: Customers complete onboarding in minutes using reusable KYC credentials.

- E-commerce and Travel: Users prove age or citizenship without exposing full identity documents.

This broad applicability positions SSI wallets as foundational infrastructure for the next generation of digital services. As adoption accelerates, expect to see further integration with decentralized finance (DeFi), NFT marketplaces, and cross-border travel systems, all benefiting from secure, portable identity verification.

The Road Ahead: User Empowerment Through Decentralized Identity

The advantages of self-sovereign identity wallets are clear: enhanced privacy and data control through zero-knowledge proofs; seamless cross-platform authentication; fraud-proof credential verification; elimination of third-party dependency; and streamlined onboarding combined with regulatory compliance. Each benefit directly addresses longstanding pain points in digital identity management while preparing both users and organizations for an increasingly interconnected world.

For those seeking to take control of their digital presence, whether as individuals safeguarding personal privacy or enterprises optimizing operations, the era of centralized identity silos is fading. SSI wallets offer a disciplined path forward built on transparency, security, and true ownership.