The landscape of financial compliance is being reshaped by wallet-linked, reusable IDs. These digital credentials, anchored in decentralized identity (DID) wallets, are rapidly transforming Know Your Customer (KYC) processes in both traditional finance (TradFi) and decentralized finance (DeFi). Instead of forcing users to repeatedly upload documents and endure lengthy verifications for every new platform, reusable digital identities enable a one-time KYC check that can be securely leveraged across multiple services, without sacrificing privacy or regulatory rigor.

What Makes Wallet-Linked Reusable IDs So Powerful?

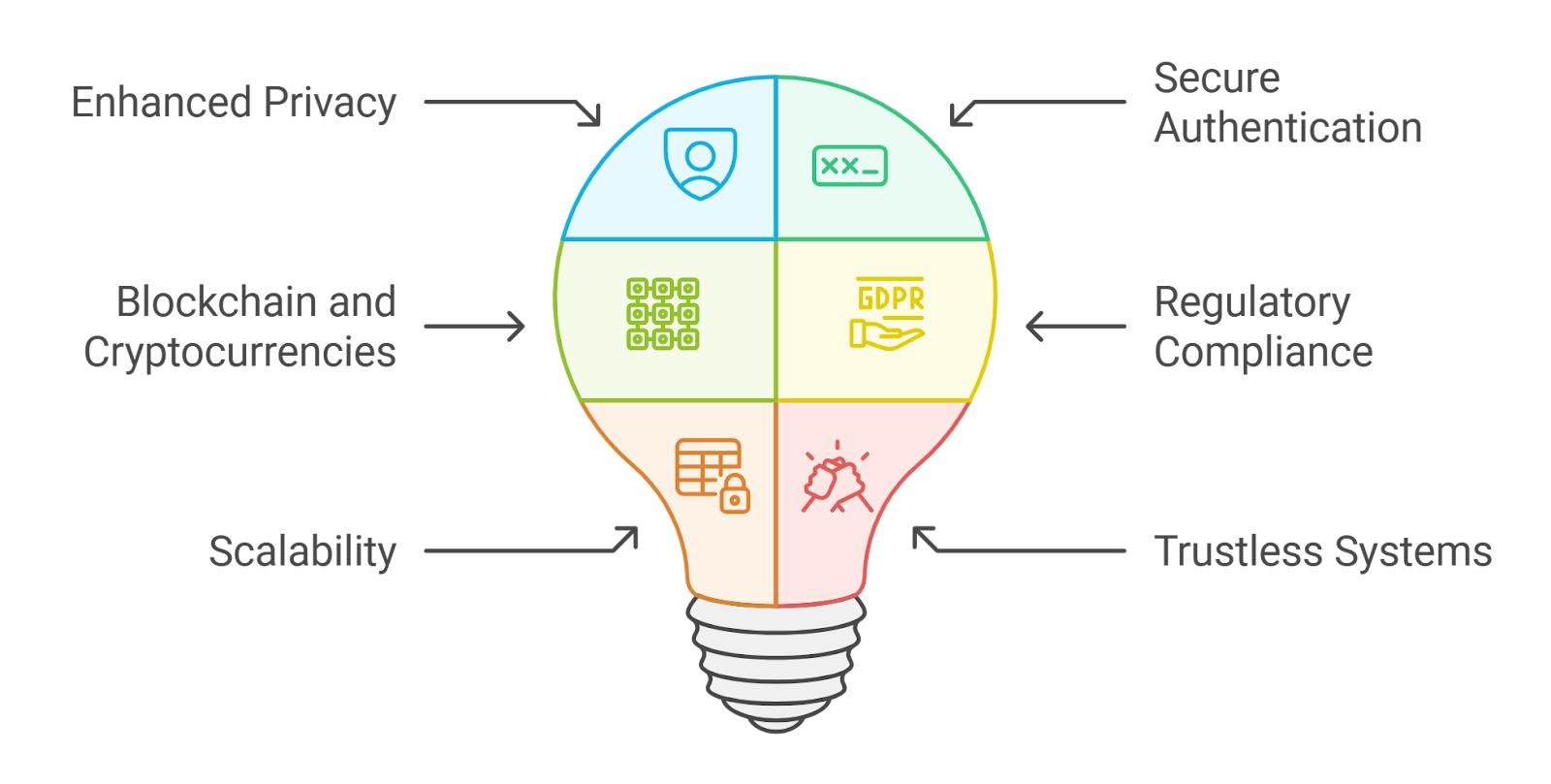

At the core of this innovation is decentralized KYC identity: users control their verifiable credentials directly within their DID or zk identity wallet. When onboarding to a new platform, whether it’s a bank, exchange, or DeFi protocol, they simply grant permission to verify the necessary information. This approach leverages cryptographic proofs and zero-knowledge technology to share only what’s required, keeping sensitive data out of centralized silos.

Top 5 Benefits of Wallet-Linked Reusable IDs

-

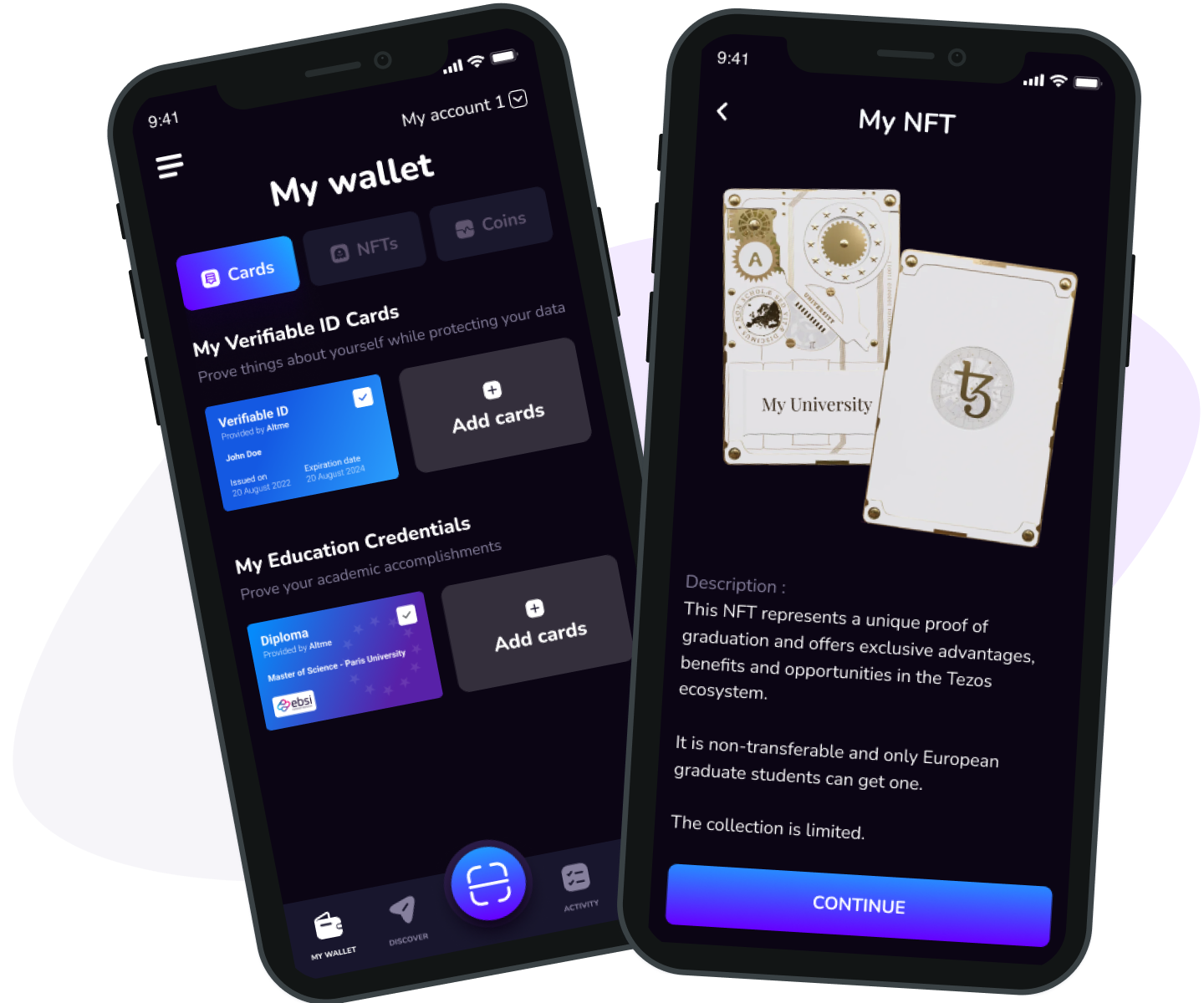

1. Streamlined Onboarding Across Platforms: Wallet-linked reusable IDs allow users to verify their identity once and reuse those credentials across multiple TradFi and DeFi platforms, drastically reducing repetitive paperwork and wait times. Solutions like Altme Wallet exemplify this efficiency boost.

-

2. Enhanced User Privacy and Control: By leveraging decentralized identity (DID) systems and zero-knowledge proofs, users can prove their eligibility without exposing unnecessary personal data. Projects like Three Protocol showcase privacy-preserving KYC in action.

-

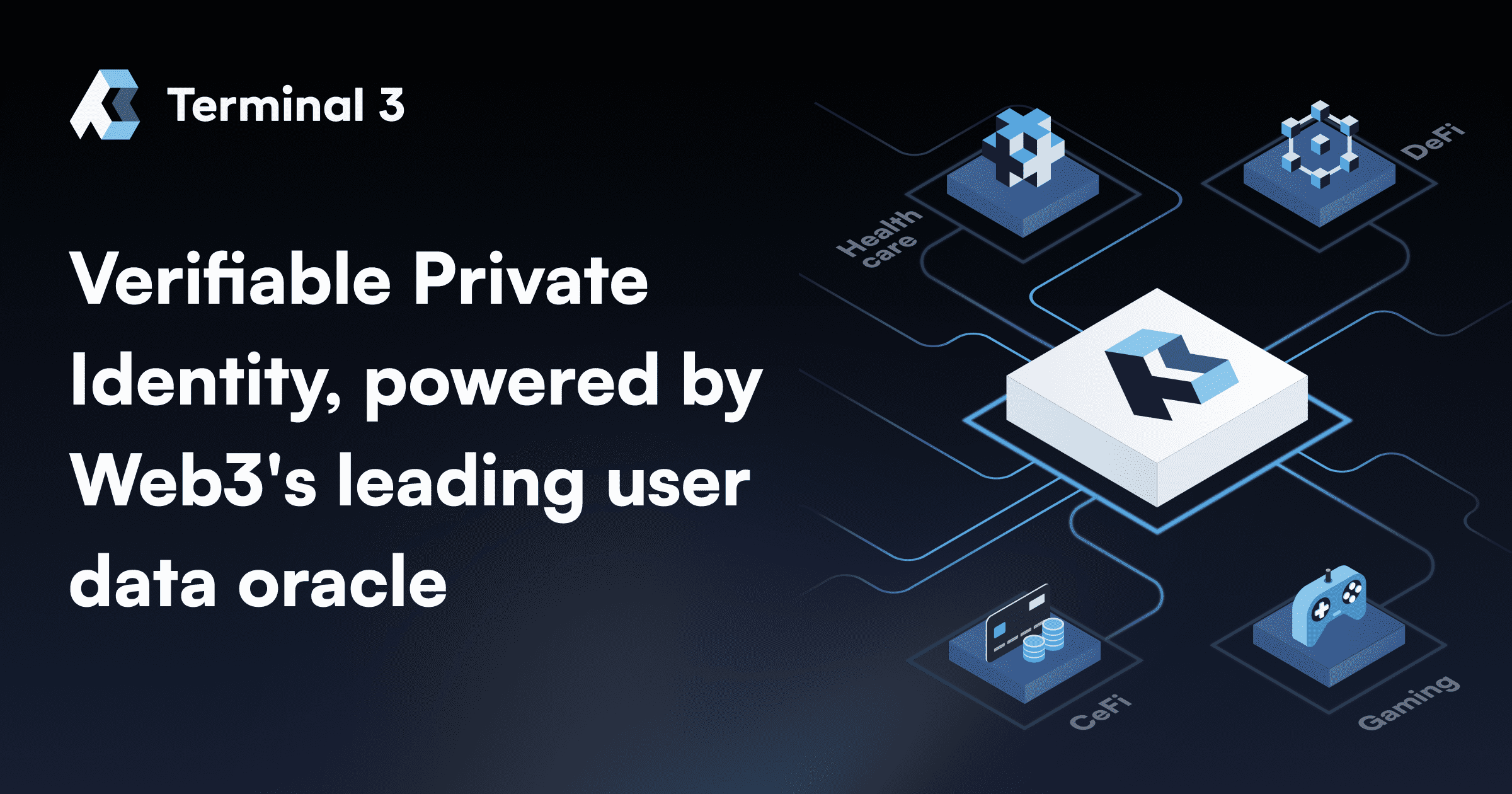

3. Improved Regulatory Compliance for Institutions: Financial institutions can meet KYC and AML requirements more efficiently by integrating reusable IDs that are designed to comply with global regulations. This reduces operational costs and audit risks, as seen with T3 Verify and its regulatory vaults.

-

4. Greater Interoperability Across Ecosystems: Reusable IDs foster seamless interaction between different DeFi protocols and TradFi services, enabling users to move freely and securely. The Transak and Privado ID partnership is a leading example of this interoperability in action.

-

5. Stronger Security and Sybil Attack Prevention: Unique, verifiable identities tied to user wallets help prevent Sybil attacks and fraudulent activity, ensuring that each participant is legitimate. This is critical for both DeFi and TradFi platforms seeking to maintain trust and system integrity.

According to Altme, self-sovereign wallets now allow individuals to manage digital identities in line with GDPR requirements. Meanwhile, projects like Three Protocol are pioneering zero-knowledge proof-based credentials (ZKi3s), letting users interact with web3 marketplaces without exposing private details or repeating the same checks everywhere.

KYC Challenges in TradFi vs. DeFi

In TradFi, KYC is synonymous with compliance, banks must verify identities to prevent fraud and money laundering. Yet legacy systems often mean each institution repeats the process from scratch, leading to friction for both users and compliance teams. Reusable digital identity flips this model: once verified by a trusted entity, your credentials can be instantly re-shared with any compliant partner.

DeFi platforms face a different dilemma. The ethos of web3 values privacy and pseudonymity; however, regulators increasingly demand robust identity checks as crypto matures. Wallet-linked IDs offer a strategic middle ground: using privacy-preserving proofs (such as zero-knowledge protocols), DeFi apps can confirm user eligibility without ever accessing underlying personal data.

How Reusable Digital Identity Works in Practice

The process starts when a user completes an initial KYC check with an approved verifier, a regulated bank, payments provider like Transak, or even an on-chain credential issuer. The resulting credential is stored in the user’s decentralized wallet as a verifiable credential (VC). When signing up for another service, be it a lending protocol or investment platform, the user simply authorizes access to their VC using cryptographic signatures.

This not only accelerates onboarding but also unlocks new interoperability between platforms. For example:

- T3 Verify stores encrypted KYC data across decentralized networks and regulatory vaults, protected by smart contracts, so users retain control while institutions remain compliant (terminal3.io).

- EUDI Wallets, as explored by Talao, promise cross-border compatibility between government-backed digital ID schemes and decentralized systems.

- IOTA Foundation has partnered with walt. id and others to create tokenized authentication systems for Web3 environments that preserve privacy while meeting regulatory demands.

The result? A more connected ecosystem where frictionless compliance becomes not just possible but expected, and where individuals finally have agency over their online identities.

As this new paradigm gains traction, both institutions and users are beginning to realize the broader implications of wallet-linked reusable IDs. For financial service providers, integrating decentralized KYC identity solutions means slashing onboarding costs, reducing fraud risk, and keeping pace with evolving regulations. For individuals, it’s about empowerment: finally having a say in when, where, and how personal data is shared, without the constant anxiety of overexposure or data breaches.

Real-World Adoption: Who’s Leading the Charge?

Several high-profile collaborations are already demonstrating the value of reusable digital identity in action. The Transak and Privado ID partnership is a prime example: users complete KYC once and can then move seamlessly between supported DeFi apps. Similarly, Altme’s wallet solution grants users GDPR-compliant control over their credentials, meaning European privacy standards are baked into every transaction.

The EUDI Wallet, as highlighted by Talao Wallet, is another milestone. It bridges government-backed digital identity with decentralized finance protocols, offering a trusted layer for cross-border transactions that satisfies both regulators and privacy advocates. Meanwhile, platforms like T3 Verify leverage smart contracts to store KYC data securely across decentralized networks and regulatory vaults, keeping both hackers and overreaching authorities at bay.

What’s Next for Privacy-Preserving KYC?

The next frontier lies in scaling these wallet-linked reusable ID systems globally, and ensuring they remain interoperable across jurisdictions and tech stacks. As more TradFi giants collaborate with DeFi innovators (and as regulators begin to recognize the legitimacy of verifiable credentials), we’ll see even broader adoption. Expect zero-knowledge proofs (ZKPs) and advanced cryptography to play an even greater role in balancing compliance with privacy.

5 Ways Zero-Knowledge Tech Improves KYC Privacy & Efficiency

-

Selective Disclosure with Zero-Knowledge Proofs: Zero-knowledge proofs (ZKPs) enable users to prove their identity or eligibility criteria without revealing underlying personal data. This means platforms can verify compliance—such as age or residency—without accessing sensitive information, greatly enhancing privacy. Solutions like Altme Wallet leverage ZKPs for GDPR-compliant, privacy-preserving KYC.

-

Reusable KYC Credentials Across Platforms: Zero-knowledge-based credentials allow users to complete KYC once and reuse their verified identity across multiple DeFi and TradFi services. Projects like Transak and Privado ID enable this, streamlining onboarding and reducing repetitive compliance checks.

-

Interoperability with Decentralized Identity Standards: Zero-knowledge credentials are built on open standards like Decentralized Identifiers (DIDs) and Verifiable Credentials (VCs). This ensures that KYC credentials can be recognized and trusted across multiple platforms, as seen with the EUDI Wallet and Altme.

-

Regulatory Compliance with Privacy by Design: Zero-knowledge technologies allow platforms to meet KYC and AML regulations while embedding privacy into the process. For example, Altme Wallet and Transak offer solutions that balance compliance and user confidentiality, making regulatory adherence seamless and user-friendly.

Yet challenges remain. Not all jurisdictions accept digital credentials as legal proof of identity; legacy infrastructure still lingers; user education is an ongoing hurdle. But the direction is clear: decentralized KYC identity isn’t just a trend, it’s becoming a foundational layer for modern finance.

Empowering Users and Institutions Alike

Ultimately, wallet-linked reusable IDs create a win-win scenario. Financial institutions gain streamlined compliance tools that reduce operational drag without sacrificing security or trust. Users reclaim agency over their identities, and can finally move between platforms without unnecessary friction or risk.

This shift isn’t just technical, it’s cultural. As more people experience the convenience of one-time verification (and the peace of mind that comes from privacy-preserving KYC), expectations will change across both TradFi and DeFi landscapes.

The age of repetitive document uploads is ending. In its place stands a new standard: portable, secure, privacy-first digital identity that works wherever you go, on-chain or off.